News

What are Some of the Most Promising DeFi Innovations on Arbitrum?

Summary: Arbitrum is currently the most prominent layer 2 in terms of total value locked by a wide margin and holds over 50% of the layer 2 market share. This is for several reasons, but primarily because of its layer 2-leading low fees and the flurry of activity and innovation taking place on the platform, taking ...

Arbitrum is currently the most prominent layer 2 in terms of total value locked by a wide margin and holds over 50% of the layer 2 market share. This is for several reasons, but primarily because of its layer 2-leading low fees and the flurry of activity and innovation taking place on the platform, taking DeFi to places never before explored. Let’s look at some of the most exciting and unique DeFi applications on Arbitrum and if they could become the backbone of the subsequent DeFi explosion.

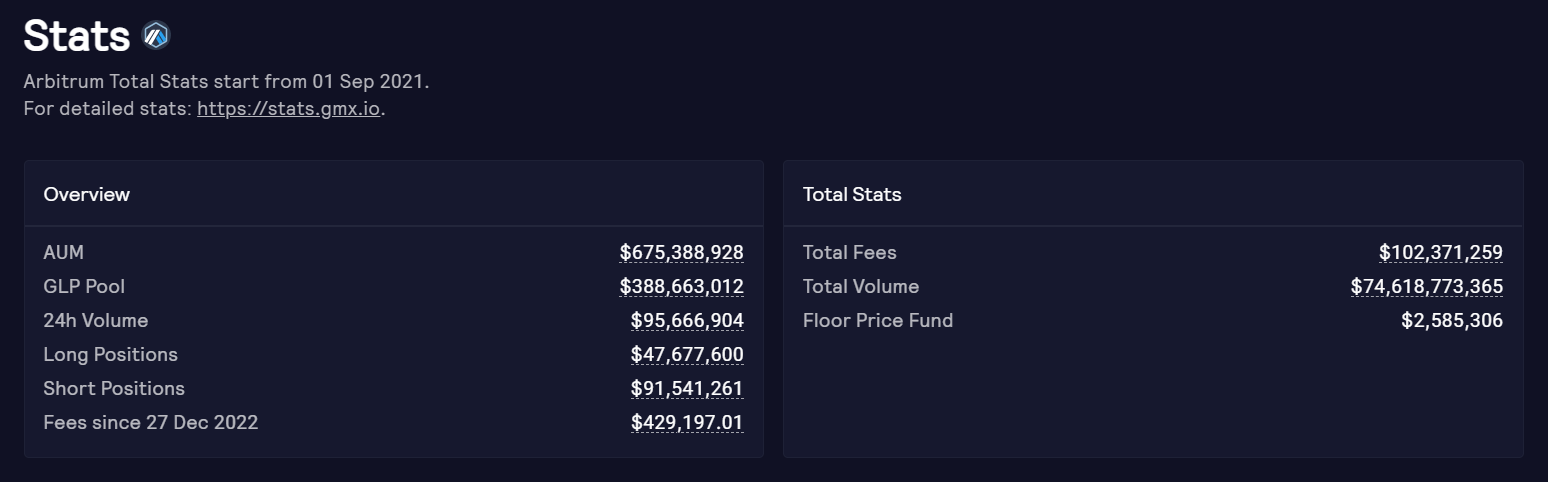

The largest DeFi app on Arbitrum in terms of market capitalization and total value locked is GMX, a decentralized perpetual exchange. GMX lets anyone speculate on top cryptocurrencies and tokens with up to 50x leverage. The GMX token is the platform’s native governance token and accrues 30% of the protocol fees. GLP is the liquidity provider token that holds a basket of currencies like Ethereum, Bitcoin, Chainlink, and Uniswap and provides liquidity for leverage trading. GLP earns 70% of protocol transaction fees and generally wins whenever the leverage traders lose. Staking GMX has an APR of slightly over 10%, mostly paid out in GMX tokens, while GLP has a slightly higher APR of 14% paid out mostly in ETH. Since its release in the Fall of 2021, the protocol has achieved $74 billion in volume and $100 million in fees. Overall, GMX has been able to dominate the Arbitrum DeFi ecosystem and provide users with a valuable service.

Y2K Finance is a relatively new dApp allowing users to bet on stablecoin depeggings and hedge their exposure. Since Terra and UST's collapse this past summer, DeFi users and investors have been wary about stablecoins. Centralized stablecoins, like USDC and USDT, pose the risk of either not being fully collateralized or being subject to strict government regulations. Decentralized stablecoins, like DAI, FRAX, and MIM could face some black swan event or exploit causing them to become worthless. Additionally, all stablecoins can face liquidity issues where more people want to sell than buy, causing a price drop. Y2K allows risk-averse investors to buy insurance on their stablecoins and get paid out if the price of the stablecoin falls below a certain threshold. Those who believe that the stablecoins will retain their value can provide the insurance coverage and get paid a premium if the stablecoins stay at their current value; otherwise, their coverage pays out those who hedged. This novel mechanism provides safety and insurance for one of the most critical aspects of DeFi and is incredibly useful in any portfolio with a large stablecoin allocation.

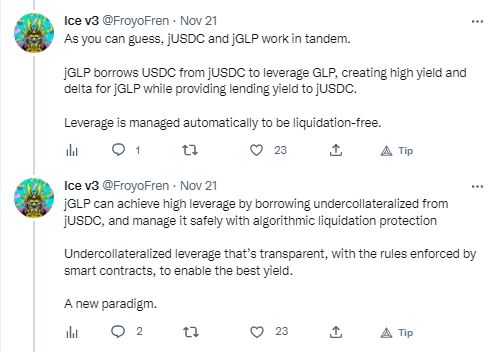

Jones DAO is a liquidity and yield protocol specializing in stability and unique products. Their vaults, which mint jAssets, can be used to get the maximum capital efficiency out of yield-bearing tokens and assets. For example, their ETH vault uses a hedged options strategy to earn 6% APY, slightly higher than what can be achieved by staking ETH. Their two upcoming products, jUSDC and jGLP, could be some of the best and most stable yield-bearing products. jUSDC is planned to be a gamma-neutral vault, meaning that the yield will not be impacted by price changes and will be based solely on GLP’s yield. jGLP will essentially act as a high-yield ETH, as explained in the below tweet from the co-founder of Jones. With continued development and a track record of success, Jones is primed to be an enticing option for anyone looking for secure yet high yields.

Last but not least, PlutusDAO is a governance aggregator built for maximizing yields and providing convenience. Their plsAssets are built with governance aggregation and liquidity maximization in mind, while their plvAssets are constructed solely for reward maximization and as a potential building block for other dApps. Fees earned from these strategies are directed toward the Plutus treasury, which is controlled by the PLS governance token. If Plutus is able to successfully capture a lot of governance tokens, they will have a large amount of control over the ecosystem and help to spearhead decisions in their best interest. For anyone looking for passive strategies and aggregation on Arbitrum, Plutus should be a protocol of interest.

Arbitrum has continuously been innovative in both its technology and application layers. The protocols mentioned above, along with many others, are paving the way for more complex and efficient DeFi protocols that could help mainstream the industry. Additionally, when the Arbitrum token is released and these protocols can provide token incentives, they may reach an even wider audience and generate enough support to be the backbone of the next generation of DeFi.

By Lincoln Murr

Tags: Arbitrum,DeFi,Ethereum,GMX,Jones,Plutus,Y2K

Link: What are Some of the Most Promising DeFi Innovations on Arbitrum? [Copy]