News

The Road to 2026: Where Is the Web3 Ecosystem Heading Next?

Summary: Pioneer Forum V: BitMart and Meriti Convene Industry Leaders in New York to Explore Market Trends, Structural Shifts, and Future Opportunities. As 2025 closes, the digital asset landscape has been fundamentally reshaped. Following 2024's "Recovery," 2025 proved to be the year of "Integration," defined by the maturation of institutional frameworks and regulatory clarity. Understanding this ...

Pioneer Forum V: BitMart and Meriti Convene Industry Leaders in New York to Explore Market Trends, Structural Shifts, and Future Opportunities.

As 2025 closes, the digital asset landscape has been fundamentally reshaped. Following 2024's "Recovery," 2025 proved to be the year of "Integration," defined by the maturation of institutional frameworks and regulatory clarity.

Understanding this trajectory is crucial for the 2026 outlook. According to industry analysis, several core narratives defined 2025:

1. The Macro Catalyst: Bitcoin's New Frontier

Bitcoin didn't just regain its previous peak; it established a historic all-time high of $126,198.07 on October 6, 2025(coinmarketcap). This landmark performance, fueled by sustained ETF inflows and increasing acceptance as a treasury asset, served as the essential macro catalyst, pulling the entire digital asset market into a new liquidity cycle.

2. Access & Integration: The ETF Floodgate

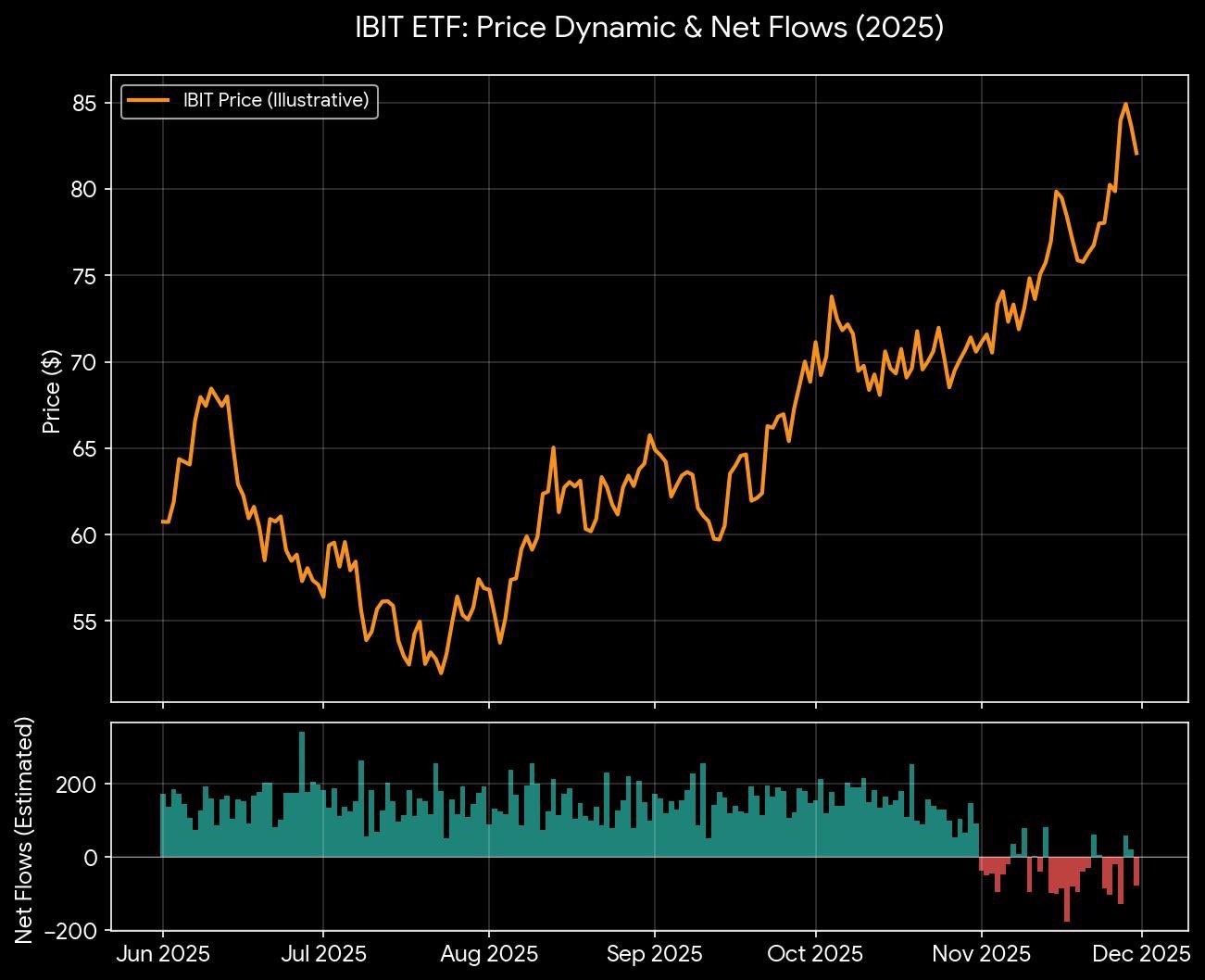

The question of approval was replaced by the question of flow. The ETF ecosystem has since become the fastest-growing segment of exchange-traded funds in decades, boasting more than 150 crypto-related products across diverse strategies. The iShares Bitcoin Trust ETF (IBIT) alone commands nearly $88 billion in AUM and saw a staggering $25 billion in net inflows through November 2025, proving massive professional capital demand.

This sustained performance reflects deep institutional conviction, underscored by growing influence from organizations like the Harvard University endowment and the establishment of the Texas Strategic Bitcoin Reserve. This integration reached a new zenith in Q4, defined by major accessibility moves: The Vanguard Group opened access to crypto ETF trading in December, and Bank of America announced its 19,000 advisors will begin recommending crypto ETFs in January. These structural commitments by Traditional Finance signal the final and irreversible acceptance of digital assets into mainstream investment mandates.

3. Regulatory Utility: The Stablecoin Race and Global Payments

Utility, not speculation, fueled growth, catalyzed by definitive policy action. The passage of the bipartisan GENIUS Act in July established a federal framework for the issuance, trading, and custody of stablecoins, instantly sparking a race among financial services firms, corporations, and even government agencies to launch new products.

This legislative clarity accelerated an already upward trajectory. Stablecoin transactions surged from $6 billion in February to $10 billion in August. According to blockchain firm Artemis, stablecoin payment volumes more than doubled year-over-year in August, with annual volumes projected to reach $122 billion if current trends continue. With the global stablecoin market capitalization surpassing $175 Billion, this utility segment is rapidly proving its potential as a compliant, global payments layer.

4. Treasury Management: The Rise of Digital Asset Treasury (DAT)

Few themes were as prominent in 2025 as the rise of the Digital Asset Treasury (DAT) company, or DATCO, which offered investors a high-octane public-market proxy for gaining direct crypto exposure. This enthusiasm was exemplified by the aggressive accumulation of Bitcoin by Strategy (MSTR) and Japan’s Metaplanet, with many publicly traded firms positioning their crypto balance sheets as their primary value proposition.

However, this speculative approach underwent a sharp correction in 2025 Q4. The challenge now lies in the market’s fading tolerance for models based on dilution and single-asset concentration without corresponding operating revenue, severely damaging market credibility. The focus has decisively shifted: the next generation of adoption demands stronger fundamentals, credible governance, and disciplined treasury strategies.

5. The Infrastructure Pivot: Compliance is the Gateway

Crucially, this wave of adoption was underpinned by a major evolution in exchange infrastructure. The final quarter of 2025 proved that regulatory adherence is the only scalable path for growth. We saw the "Great Re-bundling" as centralized platforms secured their positions as comprehensive financial super-apps. Giants like Coinbase and Kraken aggressively expanded their offerings, integrating derivatives and RWA product lines to consolidate market dominance.

Simultaneously, the excitement around prediction markets gained massive traction, signaling the market's hunger for more innovative, complex financial products built on-chain. Platforms like Polymarket saw record volumes, demonstrating the powerful demand for decentralized, real-time risk hedging and forecasting tools.

This structural shift confirms the 2026 thesis: the next wave of capital will flow exclusively through compliant, innovative gateways serving both the retail and institutional American markets.

Pioneer Forum V: Defining the Next Wave

However, the journey hasn't been a straight line up. The market consolidation and volatility observed throughout Q4—the inevitable reality check after a year of institutional integration—have left the industry with a critical question: How do we convert compliant infrastructure into sustainable, long-term growth?

As we look toward 2026, the narrative shifts entirely to broad structural changes, capital efficiency, and the next drivers of innovation.

To navigate this pivotal moment, BitMart and Meriti AI, in partnership with Bitpush News, Inception Capital, and Alpha Square Group, are proud to present Pioneer Forum V.

Taking place in New York City on Thursday, December 11, this exclusive, closed-door salon is the Forum’s first edition dedicated entirely to the Web3 ecosystem. It is a curated gathering for senior leaders, fund managers, and researchers to engage in rigorous, high-level debate.

Key Focus Areas:

-

Market Structure: Analyzing the post-ETF regulatory landscape and evolving liquidity pathways.

-

Institutional Capital: Identifying where smart money (family offices, hedge funds) is positioning for the 2026 cycle.

-

On-Chain Drivers: Deep diving into the scalability and adoption barriers for RWA and next-gen DeFi.

Featured Speakers & Voices

-

Zachary Feinstein: Associate Professor & Research Director, CRAFT Center @ Stevens Institute of Technology

-

Wilfred Daye: CEO & Co-founder, Samara Alpha Management; CEO @ Chaince

-

Rabat Tan: Co-founder & CEO, CoinBridge (Cross-Border Wealth & RWA)

-

Guyan Liu: Founder & Portfolio Manager, Miles GL Capital; Co-founder, Paimon Finance (RWA)

Join the Conversation

Attendance is strictly limited to ensure candor and depth of conversation. Following the panel discussion, guests are invited to a private networking reception.

If you are a builder, investor, or leader shaping the next era of digital assets, we welcome you to apply.

-

Date: Thursday, December 11

-

Time: 7:30 PM - 11:00 PM EST

-

Location: New York, NY (Address upon approval)

Apply to Register Here: https://luma.com/o0d3ys4b

About the Organizers and Partners

BitMart is a premier global digital asset platform serving over 12 million users worldwide. BitMart US is a fully regulated platform dedicated to serving the U.S. market. Meriti specializes in data strategy, analytics, and AI frameworks.

Strategic partners include Inception Capital, Bitpush News, and Alpha Square Group.

Tags: bitmart,BitMart US,Meriti

Link: The Road to 2026: Where Is the Web3 Ecosystem Heading Next? [Copy]