News

Retail Investors Could Be The Future Of Bitcoin, If Investment Remains Consistent

Summary: Retail Bitcoin addresses holding rounded values between one and 10 have grown consistently since the genesis block was mined in 2009, according to a report published by ZUBR on Monday, June 29. Since genesis block, the amount of Bitcoin held in these types of addresses has declined only five times. Today, there are over 215K ...

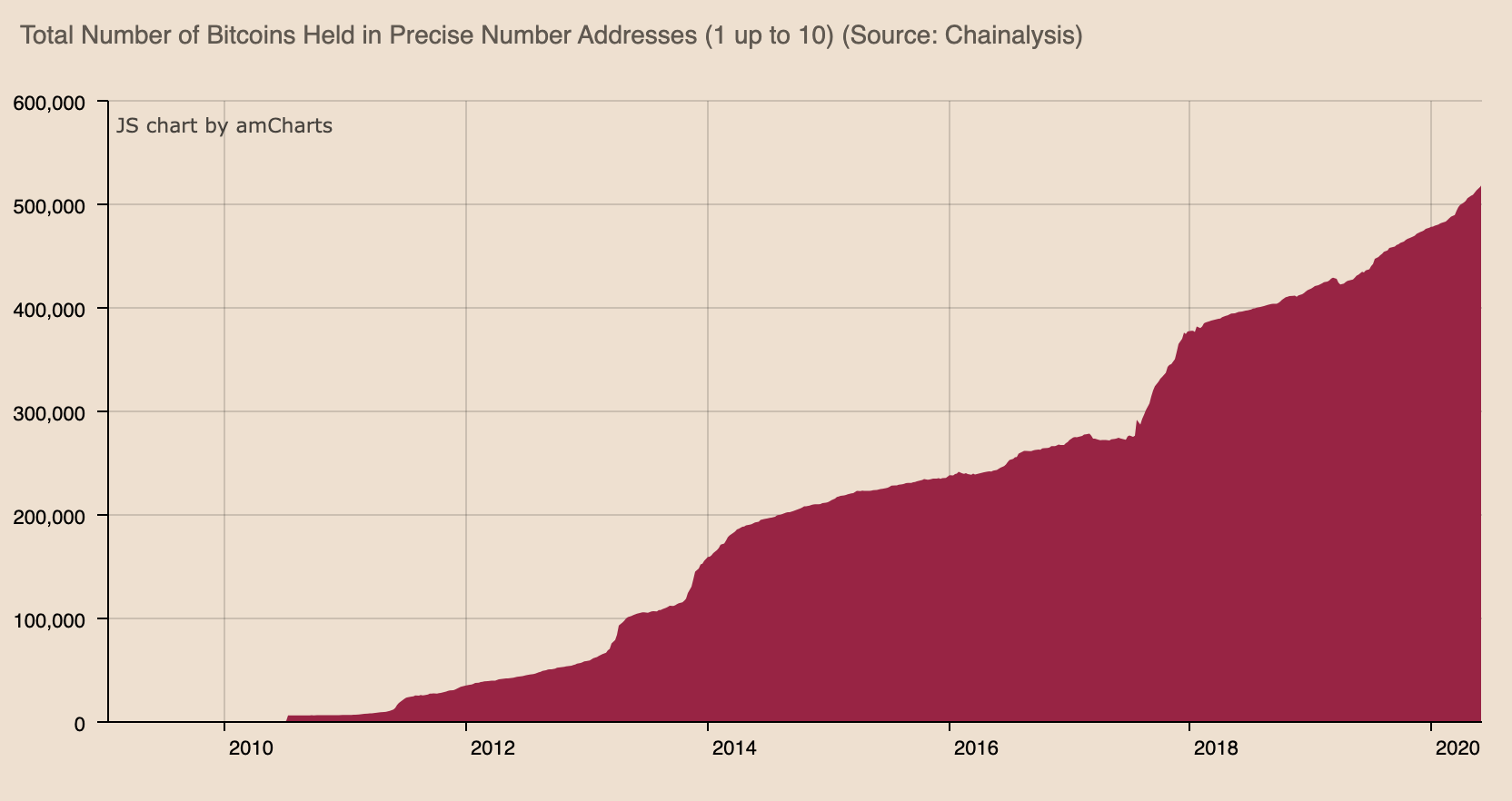

Retail Bitcoin addresses holding rounded values between one and 10 have grown consistently since the genesis block was mined in 2009, according to a report published by ZUBR on Monday, June 29.

Since genesis block, the amount of Bitcoin held in these types of addresses has declined only five times. Today, there are over 215K addresses holding a rounded number of Bitcoin up to 10 and this year alone these addresses have increased by 11%.

PC: Total number of BTC held in whole number addresses (1–10 BTC) via Chainalysis.

Despite the crypto community's preoccupation with institutional investment to signal Bitcoin's move into the mainstream, retail investors may end up being the group that sustains the currency. The performance of Grayscale's Bitcoin Trust has long been used as an indicator of institutional interest in the crypto world, but last week the price of the trust dropped by 50% as institutional investors sold off their Bitcoin after a 12 month lockup expired. The sell-off indicated that investors were not interested in long-term holding but were instead looking for short-term profit.

In contrast, retail investors are more likely to hold on to their Bitcoin holdings. While the total amount of BTC held in these addresses holding less than 10 rounded BTC accounts for only 2.5% of the total supply in circulation, they have shown consistent growth between 1% and 1.5% year-to-year.

As Bitcoin's supply dwindles as a result of block reward halving, then these small, retail investors will start to play a larger role. By 2024 the amount of Bitcoin mined is expected to drop to 450 daily. If retail addresses' growth remains consistent then these investors could hold over 50% of total supply by 2024.

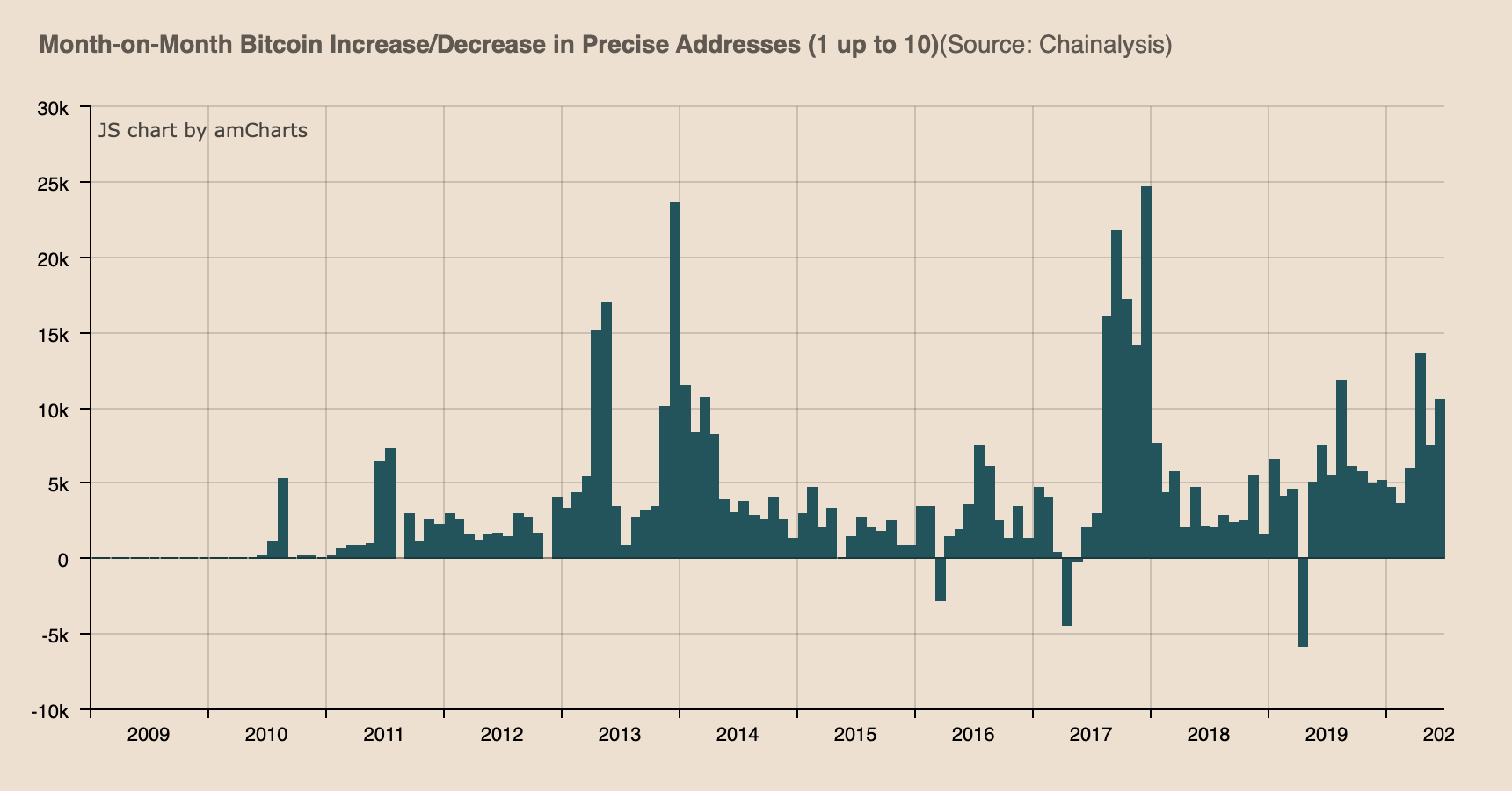

PC:Month-on-Month Bitcoin Increase/Decrease in Precise Addresses (1 up to 10) via Chainalysis.

PC:Month-on-Month Bitcoin Increase/Decrease in Precise Addresses (1 up to 10) via Chainalysis.

This outcome is only possible if retail investments continue at the same rate. If prices get too high for typial consumers as the supply starts to decline, then the prediction will be invalidated.

It is important to note that the data used in the report, provided by Chainanalysis, only included addresses holding whole numbers worth of BTC, meaning addresses holding fractional amounts of BTC.

By Emily Mason

Tags: Bitcoin,BTC,Grayscale,Grayscale Bitcoin Trust

Link: Retail Investors Could Be The Future Of Bitcoin, If Investment Remains Consistent [Copy]