News

Blockchain Ranked Among Top Ten FinTech Opportunities For 2020 By Industry Professionals

Summary: Blockchain was ranked as one of the top ten of thirty fintech trends by a group of over 1,000 professionals surveyed by The Center for Financial Professionals. Advanced data analytics were listed as the highest opportunity sector in fintech, while blockchain closed out the list. Artificial intelligence, business process automation, cloud computing and mobile services ...

Blockchain was ranked as one of the top ten of thirty fintech trends by a group of over 1,000 professionals surveyed by The Center for Financial Professionals.

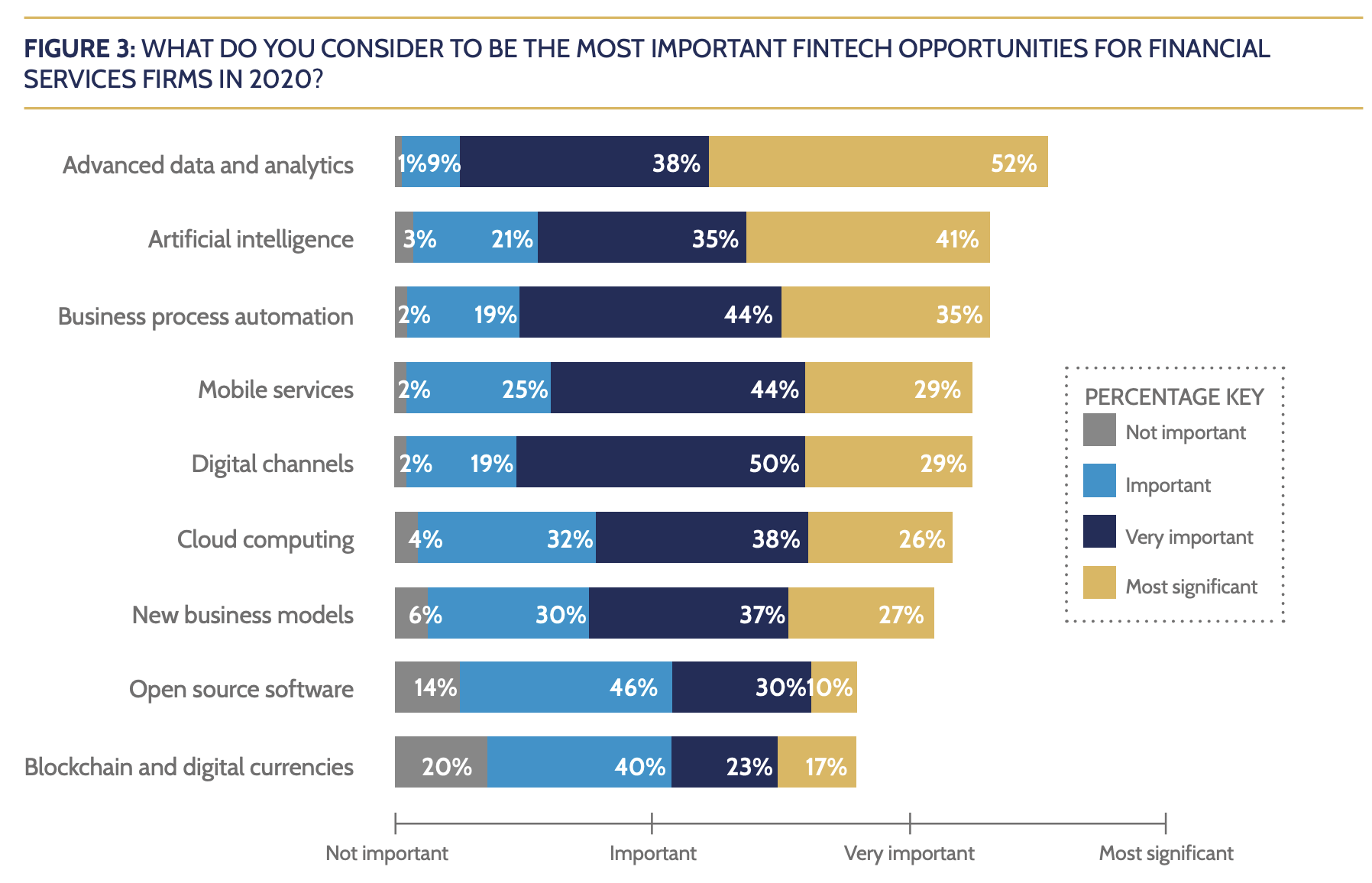

Advanced data analytics were listed as the highest opportunity sector in fintech, while blockchain closed out the list. Artificial intelligence, business process automation, cloud computing and mobile services were also ranked. 17% of respondents answered that blockchain is the most significant opportunity for financial service firms in 2020 and 63% of respondants said blockchain is either an important or very important opportunity.

Blockchain also had the highest percentage of people responding that the technology is not important at all with 20%. The closest follower was open source software with 14% responding the technology is not important. The mixed responses show that blockchain has not yet caught the attention of everyone in the banking world, unlike advanced data analytics which 52% of respondants ranked as the most significant opportuntiy in fintech with only 1% answering it is not important at all.

Regardless of where priorities lie, the report emphasized that embracing technology is going to prove crucial to thriving as a financial firm as customers are growing to expect to be able to deal with their finances digitally.

"Millennials prefer to conduct their financial services digitally, for convenience and ease," Albert Chin, CeFPro Fintech Advisory Board Member and Head of Model Risk Management at Signature Bank said. "If the traditional financial institutions choose not to adapt to these changing times, they might face the same fate as once-prominent retailers who have disappeared from their industries."

While blockchain still cracked the top ten fintech opportunities for 2020, the report noted that positive outlook regarding the technology has deteriorated from 2019. The drop was attributed to limited use, press coverage and regulatory uncertainty. These factors combined have called blockchain's relevance into question and threatened the reputation of the technology especially as press coverage often centers around crypto-related cybercrime.

The report added that cybersecurity was listed to be the largest perceived obstacle to the successful adoption of fintech technologies, indicating that if blockchain wants to break into mainstream banking it is going to have to put investors' and regulators' minds at ease when it comes to criminal activity. Security and fraud concerns will likely be the two most important points blockchain advocates will need to overcome.

Often blockchain discourse centers around overthrowing traditional banking institutions to cut out the middleman and give consumers control over their funds. The report argues that this dream is unlikely, but that fintech trends have tremendous power to disrupt the banking world.

“Fintech as an entity will not replace banks but, with so many smaller players jockeying for position and fragmenting the banking industry, it could lead to its death by a thousand cuts,” one CeFPro Advisory Board Member said.

Tags: Blockchain,CeFPro,Center for Financial Professionals,Fintech

Link: Blockchain Ranked Among Top Ten FinTech Opportunities For 2020 By Industry Professionals [Copy]