News

SushiSwap Successfully Migrates Millions Worth Of Crypto From Uniswap, But Some Worry The Vampire Attack Will Stifle Innovation In The Space

Summary: Decentralized exchange SushiSwap successfully migrated millions worth of crypto from DeFi's favorite exchange, Uniswap, on Wednesday, September 9. SushiSwap has captured the crypto community's attention over recent days as the platform attempts to not only compete with, but also steal liquidity from top decentralized exchange Uniswap. SushiSwap's anonymous founder Chef Nomi adopted Uniswap's open-sourced code ...

Decentralized exchange SushiSwap successfully migrated millions worth of crypto from DeFi's favorite exchange, Uniswap, on Wednesday, September 9.

SushiSwap has captured the crypto community's attention over recent days as the platform attempts to not only compete with, but also steal liquidity from top decentralized exchange Uniswap. SushiSwap's anonymous founder Chef Nomi adopted Uniswap's open-sourced code and introduced SushiSwap as a decentralized exchange for the people.

Chef Nomi made one defining addition to Uniswap's model — a liquidity token. In Sushiswap liquidity providers would not only be rewarded with trading fees like in Uniswap, but also with a SUSHI token which would generate revenue even if the holder stopped providing liquidity. SUSHI also acts as a governance token allowing holders to weigh in on platform updates. While Uniswap is controlled by a handful of people and operates without a governance token, Sushiswap gives stakers control over what happens in the community holding true to original DeFi values.

Initially, the way to collect SUSHI tokens was to deposit Uniswap liquidity tokens which represented a holder's deposit in the decentralized exchange. The Uniswap tokens were then swapped for the underlying asset which allowed for the migration of funds from Uniswap to Sushiswap. By Friday, September 4, $1.6 billion worth of Uniswap liquidity tokens were held in Sushiswap.

On Wednesday, September 9 Sushiswap successfully transferred millions worth of liquidity from Uniswap to Sushiswap in less than 6 hours. The decentralized exchange is now live and staker can now begin collecting SUSHI fee rewards. However, some have taken to Twitter to argue that the vampire attack on Uniswap will de-incentivise innovation in the space.

Co-organizer of PHL Blockchain and founder of Scopelift, Ben DiFrancesco, took to Twitter following the migration to argue that the event will cause all future projects to launch with a token. He expressed disappointment that Chef Nomi was able to abandon and cash out of the project for $13 million worth of Ether after taking Uniswap's work and making far less labor-intensive upgrades.

One commenter replied that the solution is to make Uniswap better than the forks, elaborating that the Uniswap team will have to innovate - and likely launch a token - in order to beat out competitors. Other commenters added that if Uniswap wanted to protect themselves they could have developed privately and that open code available for building on is a key principle of DeFi and the crypto community as a whole.

Director of Research at The Block, Larry Cermak, chimed into the booming Sushiswap-focused Twitter conversation with a preliminary test for which AMM is currently giving the best price. He emphasized that it is early to be looking at this metric because liquidity can still migrate back to Uniswap. He found that Sushiswap is offering better prices for 100 ETH orders, while Uniswap is offering better prices for 10 ETH orders.

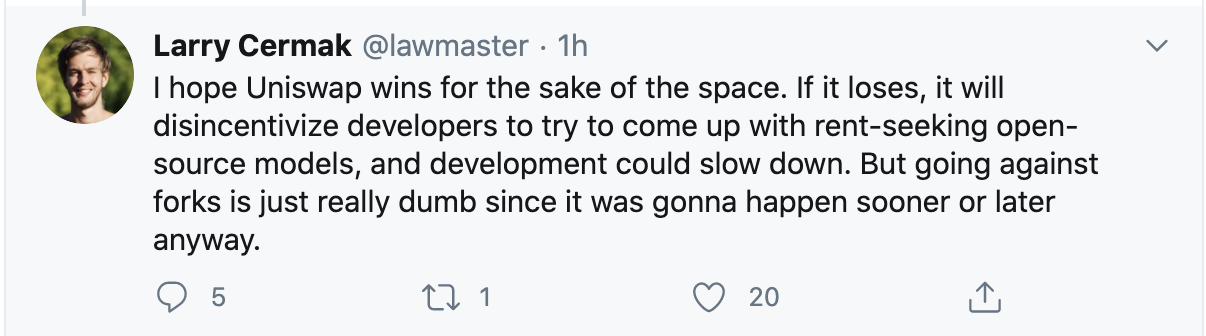

He also noted that pricing is not going to define the success of Sushiswap, which will instead be determined by the platform's ability to retain liquidity providers and capture larger volume in the coming weeks. Agreeing with DiFrancesco, he expressed that he hopes Uniswap wins over Sushiswap in the long run because otherwise developers will be de-incentivised from designing rent-seeking open-source models which could slow innovation in the space. However, he added that fighting against forks isn't worth the energy since they are inevitable and at the end of the day are the nature of DeFi.

It is also worth noting that over $200 million worth of liquidity flowed into Uniswap over the course of the the SushiSwap experiment as stakers sought to aquire Uniswap tokens to swap out for SUSHI pre-migration, so the fork may not be so harmful to the platform.

By Emily Mason

Tags: DeFi,Liquidity Provider,Sushiswap,Uniswap,Vampire Attack

Link: SushiSwap Successfully Migrates Millions Worth Of Crypto From Uniswap, But Some Worry The Vampire Attack Will Stifle Innovation In The Space [Copy]