News

Does Having Too Many Layer 2s Hurt the Ethereum Ecosystem?

Summary: Ethereum’s biggest problem is its inability to scale. This is being worked on by a plethora of protocols and companies, and there are now many Layer 2 scaling solutions being brought to market. However, with so many solutions available, projects will be spread across too many of them, and Ethereum users will lose many of ...

Ethereum’s biggest problem is its inability to scale. This is being worked on by a plethora of protocols and companies, and there are now many Layer 2 scaling solutions being brought to market. However, with so many solutions available, projects will be spread across too many of them, and Ethereum users will lose many of the benefits that Layer 2s bring.

It is no secret to anyone that Ethereum has a scaling problem. Currently, it can cost upwards of fifty dollars to make a transaction on Uniswap, and can take fifteen minutes or more. For a blockchain hoping to be a settlement layer for billions of transactions, these numbers are not sustainable, and users will leave for other blockchains unless a solution is found. One of the most common solutions are Layer 2 platforms, which allow users to make fast and cheap transactions on Ethereum, and allow the protocol to be used as intended.

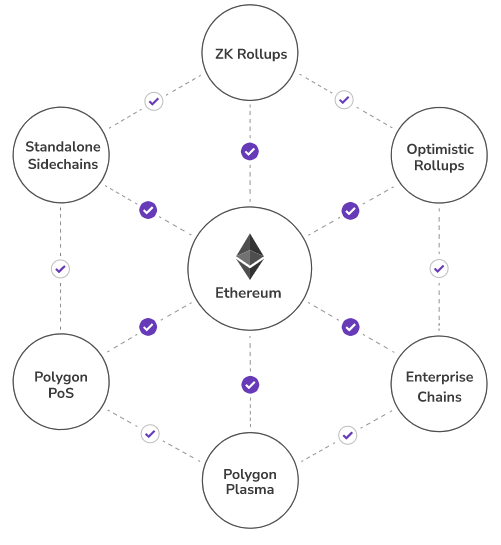

As of now, there are three main Layer 2 solutions, but there are many more in development. Polygon, which has been released for about a year, uses Plasma scaling technology and side chains in order to make fast and cheap transactions. Optimism and Arbitrum, two Layer 2s planning to release this summer, are using rollups to achieve an ideal transaction environment while being just as secure as the main Ethereum blockchain. Honorable mentions include Starkware, xDAI, and OMGX.

On the surface, having many Layer 2 options to choose from seems like a positive, as it allows for users to have choice over which platform they prefer. However, it also leads to many problems that could destroy the Ethereum ecosystem in the short term.

With so many Layer 2s to build on, many of the most popular dApps have been forced to pick a side to build with first. For example, Aave is partnered with Polygon and has deployed their smart contract on their blockchain, Uniswap and Maker DAO are planning to use Optimism, while Sushiswap and Chainlink are building on Arbitrum. Many other smaller projects are also choosing a side, and the distribution of projects seems to be fairly split between the three solutions. Of the three, Optimism seems to have the slight edge in terms of number of projects, but they don’t have enough projects onboard to be able to be the main Layer 2. Though it is possible for projects to build on multiple solutions, they still are required to choose one to initially port their project to, and the vote to join a new Layer 2 could take weeks.

Even though an obvious solution may be for protocols like Uniswap to build on all Layer 2s, this will not solve every problem. When Uniswap is on both Optimism and Arbitrum, Uniswap’s liquidity would effectively be split between the two. This means that users on both Layer 2s would experience more slippage on their transactions, meaning that they will not get as good of a deal or be able to transact as much without influencing the asset price. For dApps such as Aave, splitting liquidity would mean that both borrowers and lenders are not able to get the best interest rates possible, thus leading to an economically inefficient outcome and less of a reason for people to switch to using DeFi instead of traditional finance tools.

Furthermore, if someone wanted to take their funds from Aave on Polygon and move them to Uniswap on Optimism, they would have to first deposit funds from mainnet Ethereum to Polygon, then back from Polygon to mainnet, and finally from mainnet to Optimism. This could easily cost upwards of $100, and completely negate any benefits created by Layer 2 solutions.

We could see a situation in which there is lots of tribalism within the Ethereum community, and some users only use Optimism, while others either use Arbitrum or Polygon. It will be forced tribalism due to the high fees on mainnet, and users will pick the solution that has the majority of their favorite dApps.

In the long term, Ethereum 2.0 will solve this problem by making mainnet Ethereum fees cost pennies, but this will not be viable for another year or so.

One solution would be to create some sort of bridge from one Layer 2 to another, but this is technically difficult to accomplish without having the fees of mainnet Ethereum. The most likely scenario is that exchanges like Coinbase and Binance will launch centralized services that allow users to exchange their funds from one Layer 2 to another. This will help to solve the aforementioned problem with fees, but not entirely. Users who are unwilling or unable to create accounts that require KYC procedures will be unable to transact without significant fees.

Ideally, there would only be one or two Layer 2s that dominate the Ethereum network, each of which has a compelling suite of DeFi applications that allow users to not need to switch from one to the other regularly. Whether this happens or not is entirely up to the forces of economics and the choices made by Ethereum’s dApp developers.

By Lincoln Murr

Tags: Arbitrum,Dapp,Ethereum,Ethereum 2.0,Optimism,Polygon

Link: Does Having Too Many Layer 2s Hurt the Ethereum Ecosystem? [Copy]