News

DAOs: The Next Evolution of DeFi?

Summary: While the entire cryptocurrency market has been in a slump, there’s been one sector outperforming the rest of the market: decentralized autonomous organizations, or DAOs. The idea of a DAO is the natural evolution of DeFi, and represents a compelling investment opportunity for those who get in early, if the idea captivates investors in the ...

While the entire cryptocurrency market has been in a slump, there’s been one sector outperforming the rest of the market: decentralized autonomous organizations, or DAOs. The idea of a DAO is the natural evolution of DeFi, and represents a compelling investment opportunity for those who get in early, if the idea captivates investors in the same way DeFi did one summer ago.

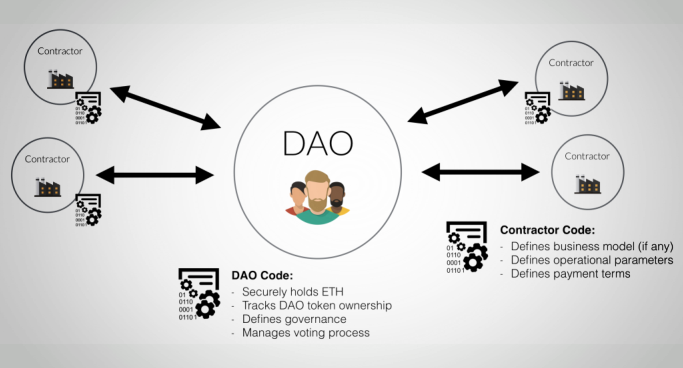

A decentralized autonomous organization, or DAO for short, is a revolutionary new model for governance that is possible due to the power of the blockchain. In a traditional governance system, like those seen in publicly-traded companies, there is a board of advisors and a team of executives who act as the central authority figures of the company. Shareholders have the right to vote on actions of the company, but the items they vote on originate from this leadership group, so an individual cannot propose a change. Furthermore, traditional companies are created as a single entity, and go through the traditional methods of hiring employees, signing contracts, and otherwise existing in the current business world.

A DAO operates in a completely different manner to this current system. Unlike a company, a DAO has no centralized authority. There are many different people with a token that represents a share of the DAO, which is known as a governance token, and anyone can vote on or propose changes to the DAO. A DAO is also governed by smart contracts and code, as opposed to contracts written by lawyers that are only as strong as their enforcement. This means that there is no fraud, embezzlement, or other shady activities that can take place in a DAO, as all the code is transparent and publicly available. It also means that conditions and actions can take place without the need for a middleman, which increases efficiency by reducing costs.

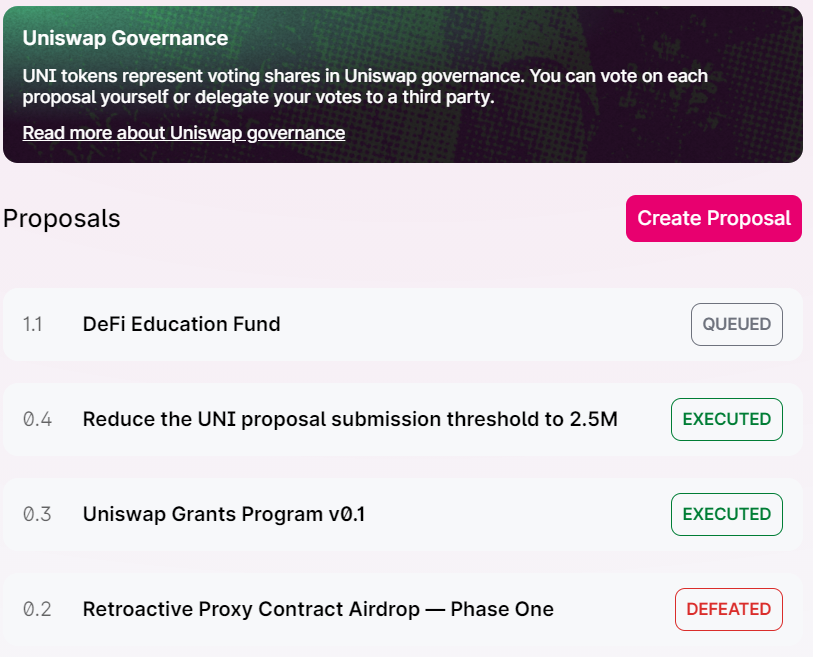

An example of a DAO can be seen in the decentralized exchange Uniswap. In September 2020, they gave users of the platform the UNI token, which acts as a governance token, and transitioned from a protocol that was owned and operated by Uniswap labs to a DAO. Now, anyone that holds UNI can vote on changes to the protocol, such as fee changes and grant approvals. If someone wants to add something to the platform, but does not see a vote for it, they can create their own, and have other UNI holders discuss and vote for it. This model is why Uniswap is one of the most decentralized and democratized DeFi products to date, and is fully in the hands of the token holders who believe in the project.

Currently, DAOs are not incredibly prevalent in the cryptocurrency space. Only about 2.5% of the entire cryptocurrency market capitalization is made up of projects related to DAOs, and this number could increase significantly in the future, as both DAO technology and awareness improves.

It is practically inevitable that DAOs will one day take over many current businesses. For example, DAOs will be instrumental in the greater proliferation of the gig economy, which was started by companies like Uber. Right now, these companies act as the middlemen, and take a cut of user’s profits in order to keep their businesses running. In fact, Uber takes anywhere from 25% to 47% of the fare that a rider pays. With a DAO, this fee could be massively decreased, and result in cheaper services available for users, while also increasing profits for drivers. Furthermore, if the “Uber DAO” followed the lead of Uniswap, who distributed tokens to users of the platform, and gave their tokens to drivers, the people that work for the DAO would have a direct influence over the future of the company, and would be incentivized to provide better service in order to increase the value of the DAO.

Much like DeFi in the summer of 2020, DAOs could become a promising investment opportunity for investors and believers in the cryptocurrency space. One year ago, the DeFi sector was only worth around $10 billion, but has now skyrocketed to over $72 billion. This was not only due to an increase in technology and opportunities available, but also because of greater interest from mainstream investors, who saw the potential of DeFi to make safe yields on stablecoins and other assets. The DAO sector is now worth $26 billion, nearly half of which comes from Uniswap.

If institutional investors become aware of the efficiencies of DAO solutions and begin to understand why they are a revolutionary model, DAO-based projects and DAO creation solutions could skyrocket in value.

It remains to be seen when DAOs will go mainstream. However, much like DeFi or NFTs, the potential for DAOs to catch the public eye is high, and it may be only a matter of time before we begin to see the DAO revolution in the business sector.

By Lincoln Murr