News

Does the ‘Coinbase Effect’ Still Exist, and What Does it Mean for the Market?

Summary: As the most popular exchange in the United States, Coinbase acts as the fiat-to-cryptocurrency onramp for millions of Americans and their billions of dollars. As a result, every time a coin has been listed on the platform, that coin experiences a massive surge in price. Recently, this trend has been dying down, which is positive ...

As the most popular exchange in the United States, Coinbase acts as the fiat-to-cryptocurrency onramp for millions of Americans and their billions of dollars. As a result, every time a coin has been listed on the platform, that coin experiences a massive surge in price. Recently, this trend has been dying down, which is positive for the market as a whole.

Back in 2017, Coinbase only listed three coins on their platform: Bitcoin, Ethereum, and Litecoin. As a result, Coinbase’s millions of users were left with little altcoin options and did not have exposure to the broader cryptocurrency market. Coinbase’s reasoning was to ensure that they were following all regulatory guidelines and not listing coins that might be labeled as securities, as well as ensuring that there was ample liquidity for the pairs supported on their platform.

In October 2018, Coinbase listed their first small-to-medium cap coin: 0x. Immediately after the announcement, 0x’s price skyrocketed from $0.65 to $1.08, solely because of its listing on Coinbase. This trend has continued over the past three years, and every coin listing has led to a massive price increase, dubbed the Coinbase Effect.

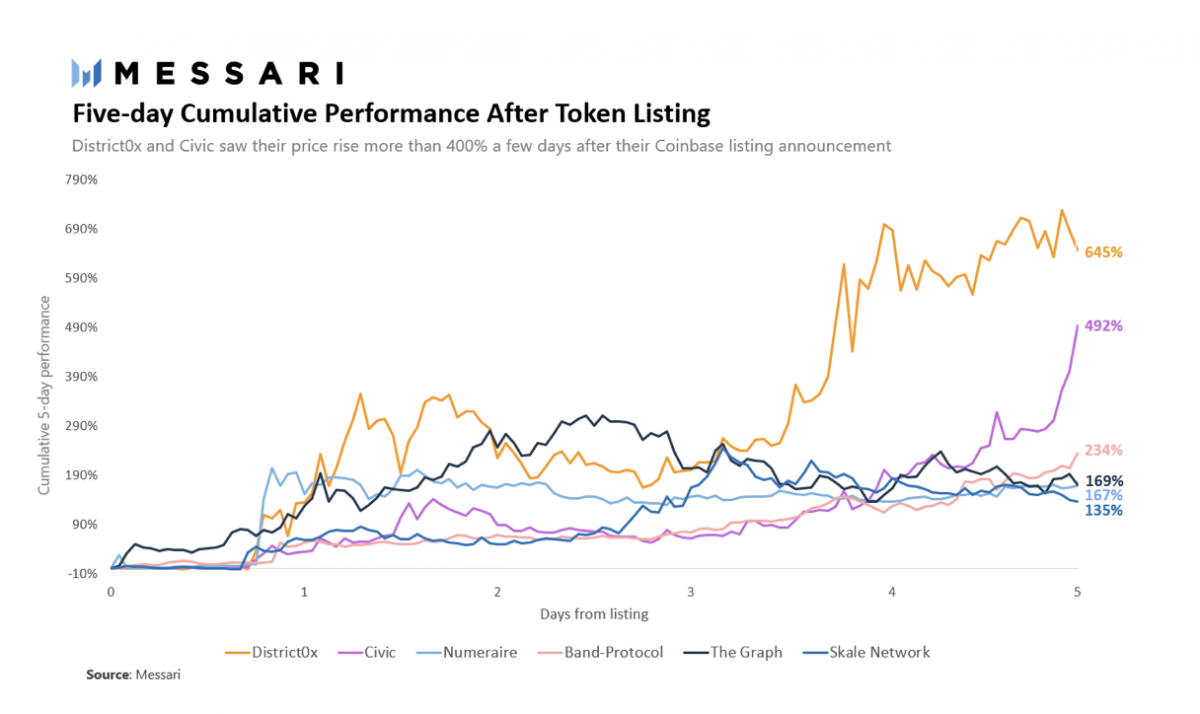

This is especially true for a couple coins, namely District0x and Civic, which saw 642% and 492% gains, respectively, after their listings in 2020 and 2018. In fact, Messari, a crypto analysis firm, estimated that the Coinbase Effect caused an average of a 92% gain five days after a coin begins trading on the platform, as of April 2021.

However, in the past three months the speed at which Coinbase has been listing new assets has greatly increased, and they have listed 20 assets since then, a near-50% increase over the number of listings from before April 2021. This means that there is a lot of new data available, which shows a different result about the impact of the Coinbase Effect.

This data shows that the Coinbase Effect still exists, but to a lesser degree.

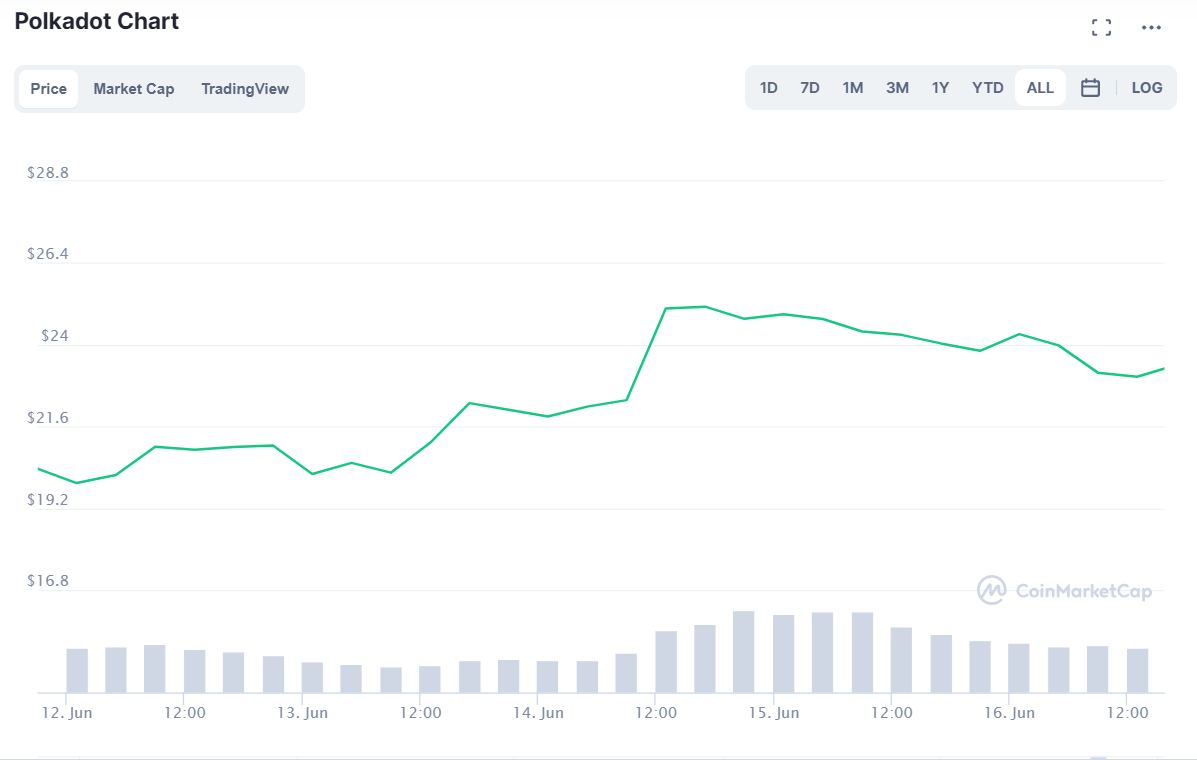

For example, the June 14 announcement that Polkadot will begin trading on the exchange caused a pump of 14%, while the June 24 announcement that Quant would begin trading caused a 50% pump. Mirror Protocol, which was announced as a trading pair on May 4, only pumped around 15%. Many of the other coins listed during this time also experienced percentage price increases in the high teens.

As one can see, the data from more recent months demonstrates that the Coinbase Effect has been much more subdued than in the past. This is expected, as with every new asset Coinbase adds, there will be less excitement about the next one, and the group of coins listed on the exchange becomes less exclusive.

Another interesting point found in the data has to do with the level of the pump compared to the market capitalization of the coin. Polkadot, which is a consistent top 10 coin, increased just as much as Mirror Protocol, whose valuation makes it the 228th biggest crypto by market cap. Enzyme, the 183rd biggest token, actually saw a decrease in their market cap after its Coinbase announcement. Initially, one would assume that the larger coins would have less of a pump, as they have more liquidity and are already quite established within the market. However, it seems that the market capitalization does not matter much. Instead, the most important factor is investor demand for an asset. Even though it takes more money to move DOT’s price than Enzyme’s MLN token price, more investors were interested in DOT, which caused it to grow much more than the small-cap MLN.

The fact that the Coinbase pump is shrinking is beneficial for the market as a whole. No exchange should have control over the price, and a lack of liquidity should not be the reason that one cryptocurrency becomes more popular than another. Furthermore, there have been accusations of insider trading before Coinbase listings, as it sometimes appears that coins increase in value a few days before a listing, signaling that employees and associates are buying before the main announcement. With every new coin listed, Coinbase’s influence over coin prices decreases, and all users have a fair chance to buy whichever crypto they want.

Coinbase has recently expressed a desire to list every cryptocurrency that they legally can. With the recent increase in listings, it seems like they are beginning to take this goal seriously, and one can expect that the number of listings will only continue to rise.

This increase in listings will cause a gradual decrease in the Coinbase Effect, until it no longer exists. With greater access into more obscure cryptos, investors around the world will experience greater exposure to the cryptocurrency market, thus bringing cryptocurrencies ever-closer to mass adoption and recognition.

By Lincoln Murr

Tags: Coinbase,Crypto,Cryptocurrency,Polkadot

Link: Does the ‘Coinbase Effect’ Still Exist, and What Does it Mean for the Market? [Copy]