News

Trump Just Opened the Floodgates: What Happens When $9 Trillion in Retirement Money Hits Crypto?

Summary: President Donald Trump is set to sign an executive order that could revolutionize the $12 trillion U.S. employer-sponsored retirement market, opening 401(k)s and other plans to alternative assets like cryptocurrencies, gold, and private equity. The Financial Times reports the order, expected this week, will direct regulators to clear hurdles for these new investments. This move ...

President Donald Trump is set to sign an executive order that could revolutionize the $12 trillion U.S. employer-sponsored retirement market, opening 401(k)s and other plans to alternative assets like cryptocurrencies, gold, and private equity. The Financial Times reports the order, expected this week, will direct regulators to clear hurdles for these new investments.

This move follows recent softening of regulatory stances, including the U.S. Department of Labor's May 28 reversal of Biden-era guidance that cautioned 401(k)s against crypto. Past legislative efforts, like Rep. Peter Meijer’s 2022 bill to include digital assets in ERISA, also foreshadowed this shift.

The order aims to diversify 401(k)s beyond traditional stocks and bonds, aligning with Trump's pro-crypto agenda. He campaigned on freeing the industry from "over-harsh regulation." His family's business has invested over $2 billion in digital assets, and his personal disclosures show over $51 million in crypto. The White House affirmed Trump's commitment to economic prosperity for Americans.

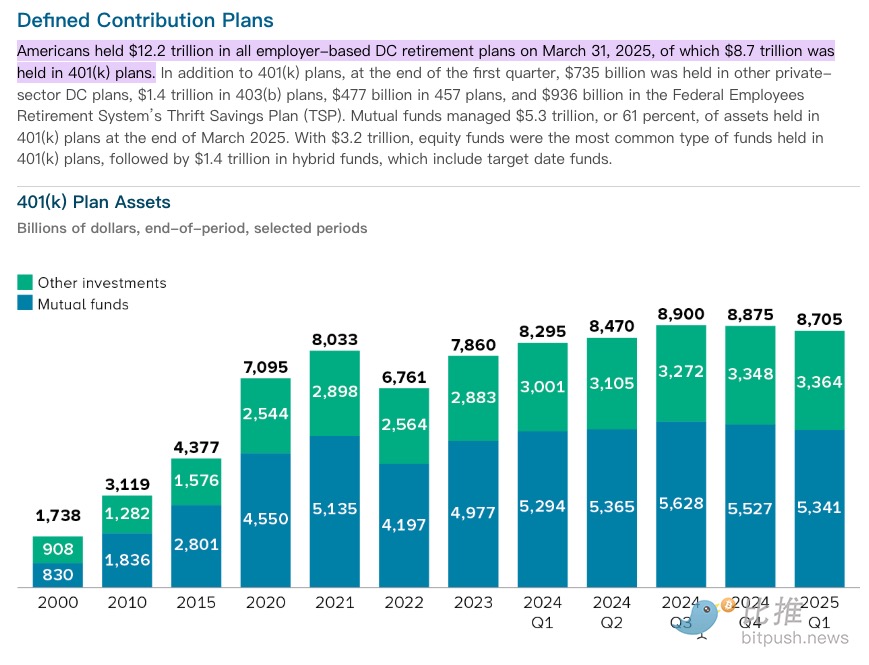

The target is substantial: As of March 31, 2025, U.S. employer-based defined contribution (DC) retirement plans held $12.2 trillion. This includes $8.7 trillion in 401(k)s, alongside $1.4 trillion in 403(b) plans, $936 billion in the Thrift Savings Plan (TSP), $735 billion in other private-sector DC plans, and $477 billion in 457 plans.

Traditionally, these vast sums, accumulated by millions of working Americans, have primarily flowed into conventional assets. Mutual funds managed 61% ($5.3 trillion) of 401(k) assets, with equity funds ($3.2 trillion) and hybrid funds ($1.4 trillion) being dominant.

The order is a major boost for private equity giants like Blackstone, Apollo, and BlackRock, who see retail retirement savings as a key growth driver. It will push the Labor Department to explore "safe harbor" provisions, easing legal risks for offering less liquid, higher-fee private investments. Firms anticipate hundreds of billions in new assets and have already formed key partnerships.

This follows moves in states like North Carolina, Michigan, and Wisconsin, which have already begun allowing crypto in some public retirement funds.

However, significant risks remain for retirement savers, including higher fees and less transparency for private assets. Industry warnings about regulatory clarity persist, and Trump's new tariff threats add macro uncertainty.

This executive order represents a pivotal moment for U.S. retirement savings. While offering new avenues for growth and participation in the digital economy, it also introduces novel risks. Its ultimate success will depend on regulators' ability to balance innovation with robust investor protection.

Tags:

Link: Trump Just Opened the Floodgates: What Happens When $9 Trillion in Retirement Money Hits Crypto? [Copy]