News

Figma's IPO Triumph and Crypto Bet: How a Design Disruptor Stunned Wall Street After a Failed Adobe Deal

Summary: The design collaboration platform Figma, the company that Adobe "couldn't get," has made a stunning debut on the New York Stock Exchange. On July 31, Figma went public with an IPO price of $33 per share, with its stock soaring to a high of $112 on its first day of trading—a gain of over 200%. ...

The design collaboration platform Figma, the company that Adobe "couldn't get," has made a stunning debut on the New York Stock Exchange. On July 31, Figma went public with an IPO price of $33 per share, with its stock soaring to a high of $112 on its first day of trading—a gain of over 200%. The rally briefly pushed its market capitalization past $50 billion, cementing its status as one of the largest venture-backed tech IPOs in recent years and signaling the return of tech unicorns after a three-year capital winter in Silicon Valley.

The public listing serves as a dramatic conclusion to the company's tumultuous journey. In 2022, design software giant Adobe attempted a $20 billion acquisition of the upstart. However, that deal was terminated in late 2023 due to significant antitrust challenges, resulting in a $1 billion breakup fee and a public display of "unrequited love." Two years later, Figma has forged its own path, creating a new legend on the capital market.

The 33-Year-Old Founder: A Design Genius and On-Chain Veteran

At the heart of Figma's success is its co-founder and CEO, Dylan Field. Born in 1992, the 33-year-old Field is a prominent figure among the new generation of Silicon Valley founders. He began his journey at Brown University, majoring in computer science, but famously dropped out after two and a half years. In 2012, at just 20, Field accepted a $100,000 grant from the prestigious Thiel Fellowship, which encourages young people to leave college and start a company. The program has also supported other key figures in the crypto world, including Ethereum co-founder Vitalik Buterin.

Field's initial vision for Figma was deeply idealistic: to make design as transparent, efficient, and collaborative as code. This led to the creation of Figma's core product, a browser-based, multi-user design tool that completely disrupted the local software paradigm dominated by Adobe. Under Field's leadership, Figma evolved from a simple tool into an enterprise-grade platform, now widely used by global companies like Google, Microsoft, Netflix, and Airbnb.

An Aggressive Web3 Strategy: From Assets to On-Chain Equity

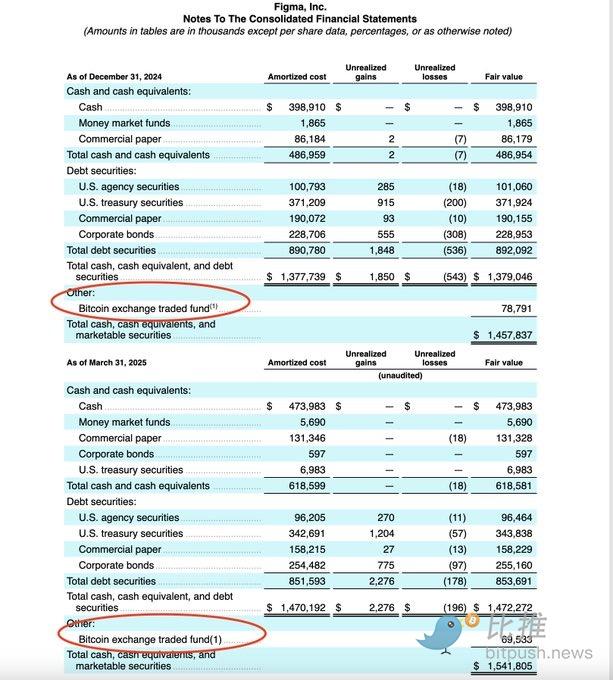

Just before its IPO, a detail that resonated deeply within the crypto community came to light: Figma holds approximately $70 million in a Bitwise spot Bitcoin ETF (BITB) and plans to acquire an additional $30 million in spot bitcoin. While Figma is not a crypto company, this move sets a potential precedent for other tech firms looking to incorporate Bitcoin into their corporate balance sheets.

Regulatory filings reveal an even more ambitious Web3 strategy. In June 2021, Figma, through an investment vehicle managed by Polychain Capital, participated in the Solana ICO.

More recently, the company's board authorized the issuance of up to 100 million shares of "blockchain common stock." This landmark decision lays the legal groundwork for future possibilities such as tokenized employee incentives, signaling Figma's intent to integrate blockchain technology into its core financial and corporate structure.

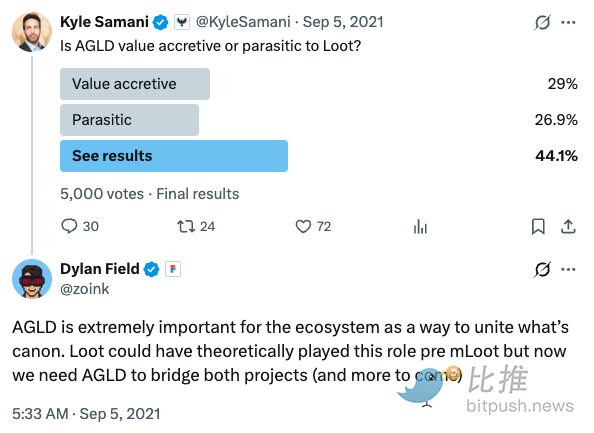

Field's personal history further explains this strategic direction. On-chain data from Arkham shows his public wallet address (starting with 0x450) purchased about $1.7 million in AGLD (Adventure Gold) tokens and 238 Loot NFTs in 2021, which he has held ever since. This, along with his role as an early angel investor in companies like OpenSea, Opyn, and PartyDAO, positions him as a seasoned crypto veteran.

A New Generation's Consensus: Figma and Robinhood

Field's journey draws parallels to that of Robinhood CEO Vlad Tenev, a fellow millennial who also made a name for himself in Silicon Valley. Both leaders have publicly shown an open attitude toward crypto assets. While Robinhood has long offered crypto trading and supports tokenized equity, Figma's embrace of digital assets and blockchain technology represents an even deeper strategic commitment.

Although Figma doesn't build crypto infrastructure directly, its collaborative design tools have become an essential "front-end engine" for the Web3 ecosystem. Numerous DAOs, DeFi protocols, NFT projects, and crypto gaming startups rely on Figma for UI/UX prototyping and community governance visualization.

Figma's IPO victory is a testament to the mindset of a new generation of Silicon Valley entrepreneurs—one that seamlessly blends AI, collaboration, open technology, and the spirit of crypto into a cohesive business strategy. As Field once told CNBC, "The stock price is just one point in time; what's more important is that we focus on our mission and listen to our users." In this regard, his philosophy mirrors that of many crypto-native founders. The true innovators, it seems, are not only challenging past titans but are also fearlessly embracing the trends of the future.

Tags:

Link: Figma's IPO Triumph and Crypto Bet: How a Design Disruptor Stunned Wall Street After a Failed Adobe Deal [Copy]