Express

Bitcoin’s Down Big, Are The Feds to Blame?

Summary: Bitcoin (BTC) has gone parabolically bad, taking a full-fledged nose dive to a depth below $32,000 which makes it the lowest price we have seen in 2022. It is currently valued at $31,395.94 which is an 8.13% dip in the last 24 hours according to Bitpush Terminal data. In the last month, BTC is down ...

Bitcoin (BTC) has gone parabolically bad, taking a full-fledged nose dive to a depth below $32,000 which makes it the lowest price we have seen in 2022. It is currently valued at $31,395.94 which is an 8.13% dip in the last 24 hours according to Bitpush Terminal data. In the last month, BTC is down $11,351.90, equivalent to a 26.54% decrease. Unfortunately for investors this doesn’t seem to be the end.

The recent decline is two-fold: the U.S. Federal Reserve increase in interest rate and the current sentiment toward the digital asset.

Firstly, on May 5 the U.S. Fed Reserve raised interest rates by half a percentage, or 50 basis points (bp), initially boosting stocks and crypto before they ultimately plummeted. The May 5-increase marked the largest single-meeting increase in more than 22 years.

It then came out that Fed Chair Chair Jerome Powell doesn’t expect the interest rate to increase more more than 50 bp in the next meetings. However, it was later revealed that despite Powell’s hypothesis, futures on the federal funds are priced in a roughly 75% chance of a 75 bp (0.75%) increase on the interest rate by the Fed Reserve at next month’s policy meeting. This is one of the main factors that has been contributing to the massive decline in BTC’s price.

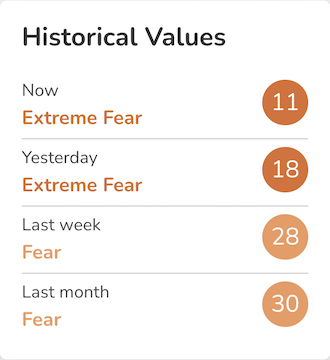

Secondly, the current short-term outlook on Bitcoin remains gloomy. According to data from Alternative, the Crypto Fear And Greed index has hit its lowest in the past three months. According to the chart below, the index was in the “Extreme Fear” zone, a sign that investors would prefer to sell at minimal loses than hold and wait for the rebound.

In addition, we have 2 other graphics we can look at from Alternative:

Vauld Insights added that Bitcoin can go in two directions from here: $29,000 or possibly reclaim the $36,000 mark, although that one looks less likely.

In addition, Galaxy Investment Partners CEO, Mike Novogratz warned that we would most likely see an additional drop in crypto when he appeared on CNBC’s Squawk Box on May 7. It seems that his prediction came true as it continued to dive down.

The one good thing for investors is that Novogratz and others have pointed out that that a lot of institutional capital is starting to flow in the crypto space: “BlackRock, BlackStone, Citadel, Apollo all building major crypto efforts.” So if you’re a long-term Bitcoin holder, you have company in your current position.

Author: Tyler Irvin