Express

MicroStrategy’s New CFO Confirms Long-Term Bitcoin Acquisition Strategy

Summary: MicroStrategy’s new chief financial officer (CFO), Andrew Kang, told The Wall Street Journal on Wednesday that the company’s long-term Bitcoin acquisition strategy won’t change despite the current trajectory of the market, which has Bitcoin and the majority of other cryptocurrencies falling since March 28. Kang said the company has no plan to sell any of ...

MicroStrategy’s new chief financial officer (CFO), Andrew Kang, told The Wall Street Journal on Wednesday that the company’s long-term Bitcoin acquisition strategy won’t change despite the current trajectory of the market, which has Bitcoin and the majority of other cryptocurrencies falling since March 28.

Kang said the company has no plan to sell any of their Bitcoin, nor have they faced pressure from shareholders to do so, according to the report.

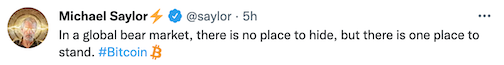

The comments from the new CFO are analogous to MicroStrategy’s CEO, Michael Saylor, who has constantly shut down rumors of microstrategy selling off their Bitcoin. In addition, Saylor has been a massive Bitcoin proponent and has only doubled down on his stance since the market has gone down, by constantly tweeting his belief in the digital asset.

Here are some recent Saylor tweets showing his support for Bitcoin.

This Kang sentiment on Bitcoin comes after MicroStrategy recently faced questions around its term loan from Silvergate and whether the company would face a margin call if Bitcoin fell under a certain price point.

Saylor confirmed that MicroStrategy has no intention of selling their Bitcoin and that they wouldn’t face a margin call unless the digital asset went to $3,562. However, if Bitcoin went to that number, Saylor noted he would be able to use either more Bitcoin or other assets as collateral to avoid selling off their Bitcoin.

As it stands, the Virginia-based company holds over 129,000 Bitcoins, according to their latest earnings release.

Bitcoin is currently being traded at $30,073, which is a more than 3% increase in the last 24 hours. Over the last seven days, Bitcoin has been staying within the $28,500-$31,200 range. Analysts are split when analyzing the short-term success of Bitcoin, but most still agree that it has long-term benefits.

Speaking on CNBC on Thursday, Peter Smith, the CEO and co-founder of Blockchain.com, said we’re now seeing “a washout of risk and leverage” from all financial markets, and it has been especially hard on the crypto market.

“This is going to be a very long process of adoption and growth, and so when you’re thinking about a crypto position, you need to average into it slowly and plan to hold it for quite some time,” Smith said.

At the time of writing, Ethereum is valued at $2,009, with an almost 2.5% increase in the last 24 hours.

Author: Tyler Irvin

Tags: Bitcoin,Ethereum,MicroStrategy

Link: MicroStrategy’s New CFO Confirms Long-Term Bitcoin Acquisition Strategy [Copy]