News

Guggenheim CIO Gives Low Bitcoin Price Prediction; Ray Dalio has small Bitcoin percentage

Summary: Guggenheim Partners’ chief information officer (CIO) Scott Minerd claims we have not seen the bottom of Bitcoin (BTC) this bear market and suggests we could see numbers as low as $8,000 before we see the price reverse and trend back in a positive way, when he appeared on CNBC’s Squawk Box on Monday. "When you ...

Guggenheim Partners’ chief information officer (CIO) Scott Minerd claims we have not seen the bottom of Bitcoin (BTC) this bear market and suggests we could see numbers as low as $8,000 before we see the price reverse and trend back in a positive way, when he appeared on CNBC’s Squawk Box on Monday.

"When you break below $30,000 consistently, $8,000 is the ultimate bottom, so I think we have a lot more room to the downside, especially with the Fed being restrictive," the founding managing partner Minerd explained, in reference to the Federal Reserve increasing interest rates.

Bitcoin is currently trading at $29,304, bringing the valued digital asset down 3.5% in the last 24 hours, according to Bitpush Terminal data. In the last seven days Bitcoin has been bouncing between $28,700 and $30,600, unable to make that breakout in either direction. It’s only a matter of time before it does so, and investors are surely hoping it goes up. While Minerd called the majority of cryptocurrencies “junk,” he did list Bitcoin and Ethereum as two “survivors.” However, he feels that we have yet to see the true dominant player in crypto. He feels that despite their price and moderate success, Bitcoin and Ethereum are still flawed: they don’t hold their value well and they aren’t used for daily transactions.

The CIO for the company holding more than $323 billion in assets under management has been fairly forthcoming with his Bitcoin predictions. The price prediction on Monday, followed a December 2020 price prediction that estimated the king of crypto would eventually be worth $400,000 per coin.

Billionaire Ray Dalio and His Bitcoin Percentage

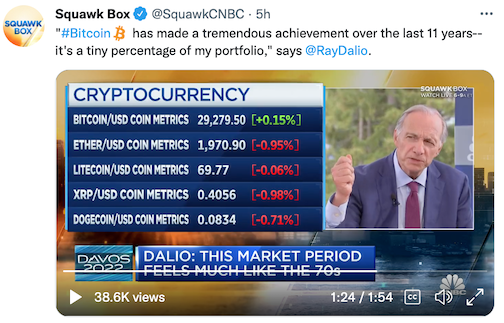

Billionaire Ray Dalio also found himself on CNBC’s Squawk Box on Tuesday, giving his opinions on Bitcoin among a plethora of other hot topics. The Bridgewater Associates founder, said that while he doesn’t allocate a large percentage of his portfolio to Bitcoin, he pointed out that the digital asset has come a long way in the last 11 years.

He also noted that while he believes Bitcoin serves a purpose, and same with gold, enthusiasts are too caught up in it and suggests taking a holistic approach when sorting out investments.

“I think the Bitcoin people get too preoccupied with it, the gold bugs get too preoccupied with it,” said Dalio. “I think you have to look at the broader set of assets.”

While Dalio has been far from a Bitcoin evangelist, his stance on Bitcoin has changed dramatically in the past couple of years. At Davos 2020, Dalio said that Bitcoin was not money because it did not function in the traditional way that money operates. However, the narrative of Bitcoin and Dalio’s stance has begun to change. Afterall, Bitcoin is slowly taking on a more traditional use in the world economy.

In addition, Dalio noted that Bitcoin can be great for wiring money across borders. He also mentioned that “cash is trash” and said that all currencies will be currencies that “go down” in relationships to goods and services.

Author: Tyler Irvin

Tags: Bitcoin,Crypto,Ethereum

Link: Guggenheim CIO Gives Low Bitcoin Price Prediction; Ray Dalio has small Bitcoin percentage [Copy]