News

XRP Lawsuit Victory: What Does it Mean for the Future of Crypto?

Summary: After nearly three years of legal battles in the most high-profile lawsuit in cryptocurrency history, Ripple Labs has finally proven in the US court system that the XRP cryptocurrency is not a security, as the Securities and Exchange Commission alleged. This outcome will have vast and significant impacts on the blockchain industry and is one ...

After nearly three years of legal battles in the most high-profile lawsuit in cryptocurrency history, Ripple Labs has finally proven in the US court system that the XRP cryptocurrency is not a security, as the Securities and Exchange Commission alleged. This outcome will have vast and significant impacts on the blockchain industry and is one of the most positive signs for the future of Web3 that we’ve seen in years. Let’s explore XRP’s history, the details of the judgment, and what it could mean for the future of crypto.

Ripple Labs, the parent company behind XRP, was founded by Jed McCaleb, Arthur Britto, and David Schwartz in 2012. It aimed to create a more efficient and cost-effective way to send money internationally. XRP, which was originally known as Ripple, was intended to be a bridge between different fiat currencies and be the fuel powering the blockchain settlement network facilitating these transactions. They consequently targeted partnerships with traditional financial institutions and successfully courted American Express, MoneyGram, Santander, and more into pilot programs and in some cases full integrations with Ripple’s services to reduce friction in international financial transactions. Their lofty yet realistic goal of integrating into the current financial system instead of overthrowing it, along with their track record of success, made XRP one of the most popular cryptocurrencies in the 2017 bull market where it reached a peak valuation of $125 billion, and it has remained relevant ever since.

In December 2020, the SEC, the regulatory body with jurisdiction over security assets and exchanges, charged Ripple Labs with a lawsuit alleging that XRP is a security and that their initial sale constituted an unregistered securities offering. The news came as a shock to the cryptocurrency industry, as it was the first time US regulators went after a large and established cryptocurrency. If XRP were to be named a security, it would be subject to the rules and regulations of other securities like company stock and exchanges would have to have proper licensure to list the asset. The case promised far-reaching consequences - XRP being a security meant there would be a strong precedent for other cryptocurrencies to fall under the same category, leading to a domino effect that could topple the booming crypto industry.

For the past three years, Ripple Labs has been fighting these accusations with full force. They argue that XRP is not a single investment vehicle since it is used for sending payments. They also state that it does not involve a reasonable expectation of profits, a requirement for an asset to be named a security, because of its use case and value coming from simple asset demand.

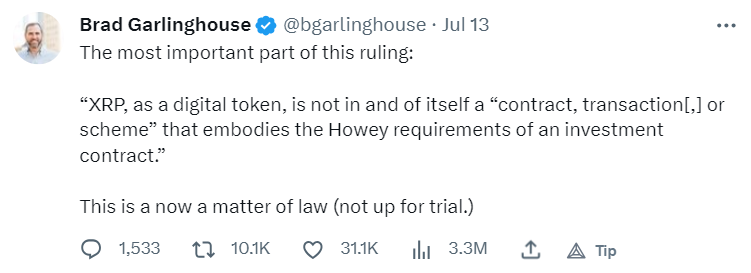

Last week, it was finally made clear that XRP is unequivocally not a security. This brought relief to the cryptocurrency community. Interestingly, the ruling stated that Ripple Labs violated securities laws when they offered the token to accredited investors and that the sales were securities transactions. However, sales of the token on exchanges to retail investors were not securities transactions since buyers would have no way of knowing about the Ripple Labs entity and are not directly dealing with them.

This ruling will impact the entire market in a mostly positive way. One of the most obvious side effects is that it will be significantly more difficult to label other cryptocurrencies as securities, especially since XRP has always been considered one of the more centralized coins. It’s virtually guaranteed that Bitcoin and Ethereum are safe from this classification, and likely other smart contract platform coins. Coinbase, which has an ongoing lawsuit with the SEC over listing securities and operating as an unlicensed exchange, now has a much stronger argument for its innocence. The case, unfolding over the last couple of days, will hopefully lean in Coinbase’s favor and ride the momentum from this previous ruling.

Corporations previously hesitant to adopt blockchain technology may now be more likely to use smart contracts or other Web3 tools to create value in their companies. Before this ruling, the risk of bad press and legal fees was not worth the potential benefits of using crypto. However, the safety provided by this ruling will provide a greater legal cushion for anyone wanting to get involved in the blockchain space.

The end of this lawsuit may catalyze another wave of cryptocurrency interest, adoption, and development. The clarity around XRP’s legal status is a tremendously positive moment for the entire space and demonstrates that even though the SEC and chairman Gary Gensler are attempting to regulate the industry unfairly, the US legal system provides the checks and balances to encourage innovation and growth within the space.

By Lincoln Murr

Tags: Blockchain,Cryptocurrency,Ethereum,Ripple,SEC,XRP

Link: XRP Lawsuit Victory: What Does it Mean for the Future of Crypto? [Copy]