News

Inscriptions: A Recent Fad or Here to Stay?

Summary: Almost every major smart contract platform has seen an unintentional stress test lately as users experimented with a new type of token standard, called an inscription, which has already been done hundreds of millions of times over the past week. Originally created on Bitcoin, these tokens are significantly cheaper than standard ERC-20 tokens, but come ...

Almost every major smart contract platform has seen an unintentional stress test lately as users experimented with a new type of token standard, called an inscription, which has already been done hundreds of millions of times over the past week. Originally created on Bitcoin, these tokens are significantly cheaper than standard ERC-20 tokens, but come with many other tradeoffs. In this article, we’ll explore the history of inscriptions, their pros and cons, and determine whether or not they’re here to stay.

Bitcoin has historically been very simple in its purpose: to be a protocol for peer-to-peer electronic cash. Since its conceptualization in 2009, blockchain use cases have been expanded far beyond this initial vision, and protocols like Ethereum and Solana have created thriving ecosystems based on their smart contract platforms, allowing arbitrary code to be published on the blockchain. Thus far, the primary use case of smart contracts has been for decentralized finance and token creation. The tokens are particularly interesting, as they allow anyone to create a representation of value and automatically have the ability to digitally mine, own, and trade these tokens in a trustless and immutable manner.

Early in 2023, the Ordinal Theory concept was released. Basically, it had the idea to number satoshis, the smallest denomination of a Bitcoin representing one one-hundred-millionth of a coin, based on their order of minting. This has the consequence of making each satoshi also an NFT with an associated numbering. Though initially used to create Bitcoin-based NFTs called digital artifacts, it was expanded into creating fungible tokens by X user @domodata. By inscribing a satoshi in a specific format with code, it can be interpreted as a token creation or minting, and future actions can move or exchange the tokens. These tokens were called BRC-20s, after the popular ERC-20 token standard from Ethereum.

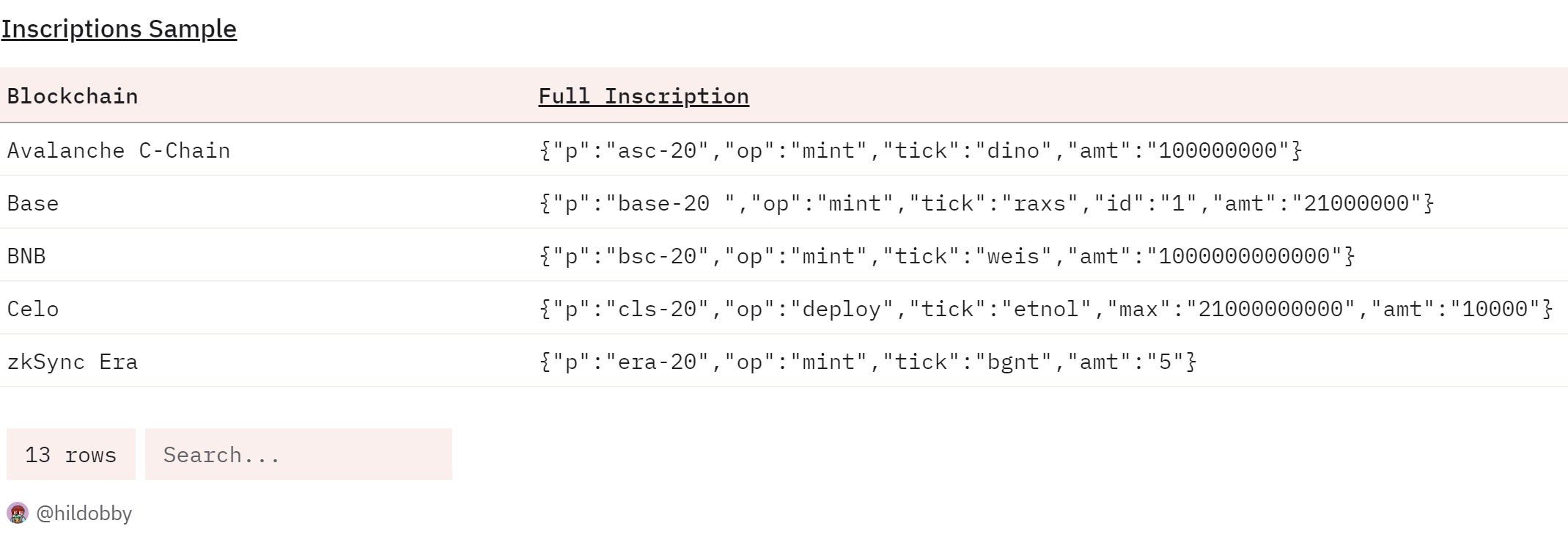

BRC-20s were primarily used for creating memecoins and never saw massive adoption. However, the trend of using inscriptions to create tokens has recently spread far beyond its origins on Bitcoin. Nearly every major chain and Layer 2, including Ethereum, Avalanche, Celestia, and Polygon, among others, have had a surge in transactions creating Ordinals. Inscriptions work by writing information directly into the calldata storage section of a block. Typically, calldata includes information specific to a smart contract call or Layer 2 data and can be interpreted by a blockchain’s virtual machine. However, Ordinals write their inscriptions in their new format in this calldata and rely on an external indexer to recognize and track the token information.

Some blockchains have handled the flood of Ordinals transactions better than others. Avalanche experienced massive spikes in transaction fees, while Arbitrum’s layer 2 sequencer went down for a short period, effectively halting the chain. NEAR, Polygon, and Celestia performed well under the pressure and saw negligible transaction fee increases. At the very least, this was a good stress test for these protocols before a real bull market with genuine users brings blockchains to their limit.

The main benefit of Ordinals is that they are significantly cheaper than normal ERC-20 token activities. This is primarily because they only require storing data on-chain, and not executing it in a smart contract-compatible environment. Consequently, they rely on external indexers, which are both centralized and unreliable, to track the token movement. In a world of “verify, don’t trust,” inscriptions make it difficult to do either compared to ERC-20. Additionally, since they aren’t smart contract-enabled, they are much simpler than other token types and do not offer many options for operation except the most basic minting and swapping features. In some sense, it is a step backward from what we currently have for the sake of cheaper transactions.

More likely than not, inscriptions will come and go as a fad and a great real-world stress test. Though there have been a staggering number of inscriptions, there have yet to be any real projects using an inscription-based token as their main product, and the vast majority are memecoins with no real use case. It is fascinating that this is the first time since the creation of Bitcoin that something from its chain has been used as an inspiration for so many others, and it represents a cultural shift within the Bitcoin community that could ultimately lead to more innovative developments in the future.

By Lincoln Murr

Tags: Arbitrum,Bitcoin,celestia,Ethereum,Inscriptions,NFT,Ordinals

Link: Inscriptions: A Recent Fad or Here to Stay? [Copy]