News

Nasdaq Takes Aim at 'Crypto-Flipping' Companies with Stricter Rules

Summary: Nasdaq is set to tighten its grip on publicly listed companies that use capital raises to purchase cryptocurrencies. According to a report from The Information, the exchange plans to require these firms to seek shareholder approval and provide detailed disclosures on the use of funds, associated risks, and the impact on their core business. Companies ...

Nasdaq is set to tighten its grip on publicly listed companies that use capital raises to purchase cryptocurrencies. According to a report from The Information, the exchange plans to require these firms to seek shareholder approval and provide detailed disclosures on the use of funds, associated risks, and the impact on their core business. Companies that fail to comply could face suspension or even delisting.

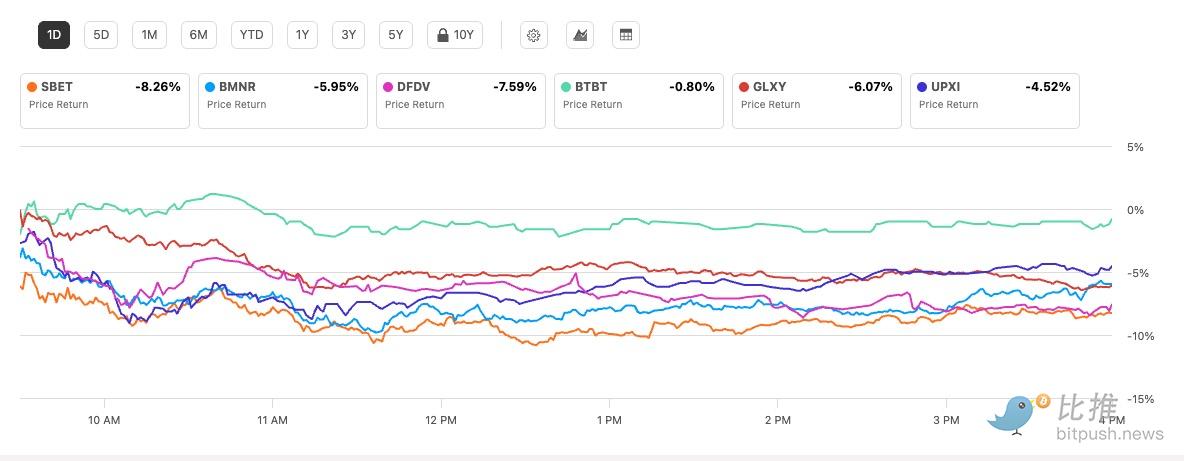

The news has already sent ripples through the market, with the share prices of several crypto-related companies dipping and the broader crypto market experiencing a brief downturn.

A Wave of Crypto Fund-Raising: $98 Billion and Counting

Nasdaq’s move is a direct response to a surge in a specific type of fund-raising activity.

A Q3 2025 research report by investment bank Architect Partners revealed that since January 2025, over 154 U.S.-listed companies have proposed or completed capital raises explicitly to "purchase Bitcoin or other cryptocurrencies." The total amount raised for this purpose has reached a staggering $98 billion, dwarfing the $33.6 billion raised by just 10 companies in all previous years combined.

Many of these companies, while using terms like "blockchain strategy" or "treasury diversification," were effectively looking to ride the crypto bull market. Their strategy often involved becoming a "stock proxy" for a hot token—buying large quantities of a specific cryptocurrency (like BTC, ETH, or even a meme coin) to position their stock as a way for investors to get indirect exposure to that asset. This strategy has proven effective, particularly in a bull market, for boosting share prices, generating buzz, and enabling major shareholders to cash out at high valuations.

Nasdaq’s new policy is aimed at curbing this financial speculation, which it sees as a departure from a company’s primary business.

Behind the Market Reaction

The market response was immediate. Shares of companies with significant exposure to crypto assets fell sharply. This volatility reflects not just a natural reaction to the perceived headwind but also a re-evaluation by investors of the true value and compliance costs associated with "crypto-concept stocks."

Since the Trump administration, the U.S. has adopted a relatively hands-off approach to crypto regulation, with federal agencies like the SEC and CFTC lagging in their enforcement and legislative efforts. This permissive environment allowed many companies to aggressively pursue crypto asset acquisition, giving rise to a new class of firms whose core narrative was simply "holding crypto."

However, after a series of incidents where companies hyped their stock with crypto narratives only for the price to collapse after executives sold their shares, exchanges, as front-line regulators, have been forced to act. Nasdaq’s new policy can be seen as a form of "gap-filling regulation"—maintaining market order and protecting investors in the absence of a comprehensive federal framework.

In fact, this isn’t Nasdaq’s first show of caution in the crypto space. From delaying the listing of several crypto mining companies to requiring stricter disclosures from firms with high blockchain-related revenue, the exchange has consistently prioritized risk mitigation over innovation.

The Double-Edged Sword

Critics argue that while Nasdaq's move is logical, it carries the risk of "overreach." Some companies genuinely trying to integrate blockchain technology into their core business—such as those developing digital supply chain finance or tokenized assets—may be deterred by the increased compliance costs. The lengthy shareholder approval process and complex disclosure requirements could cause them to miss critical market opportunities.

Moreover, overly strict rules could push innovative companies toward private markets, other international exchanges (like those in Canada or Singapore), or even direct fund-raising via DAOs and token structures. This could weaken Nasdaq's own competitiveness and stifle the innovative spirit of the U.S. capital markets.

For investors, Nasdaq's heightened regulation is a double-edged sword. On the positive side, it can reduce market manipulation like "pump and dumps," curb pure speculation, and protect retail investors from information asymmetry.

But on the other hand, the "raise-buy-sell" model was a high-return strategy for some investors during the bull market. With these high-volatility, high-reward opportunities potentially diminishing, investors may need to turn to other vehicles, such as spot Bitcoin ETFs, futures ETFs, or trusts, to get crypto exposure, or they may have to accept a market with more stable returns but less explosive growth.

Nasdaq’s decision is likely to set a precedent for major global exchanges. While NYSE and CBOE have not yet implemented similar policies, they are closely watching the market and regulatory response. It's not out of the question that a universal "corporate crypto-holding disclosure standard" could emerge in the U.S. and even globally.

Meanwhile, companies are already adjusting their strategies. Many are re-crafting their fund-raising plans, rebranding "cryptocurrency investment" as "digital treasury management" or "blockchain technology development" to avoid direct scrutiny. Legal teams are busy interpreting the new rules, and the cost of shareholder communication has risen significantly.

Regardless of the outcome, Nasdaq appears to be trying to balance its two roles: a platform for innovative companies and a guardian of market integrity. This regulatory experiment may ultimately not be about whether to regulate, but about how to regulate in a way that is both fair and smart. The convergence of the crypto world and traditional finance is irreversible, but the path will undoubtedly be filled with similar clashes and compromises.