News

The Crypto Treasury Boom Meets Regulatory Chill: Is the DAT Frenzy Fading?

Summary: In the summer of 2025, Digital Asset Treasury (DAT) companies became one of the most heated topics in capital markets. From continued crypto acquisitions by established players like Strategy to mid- and small-cap firms raising funds to directly purchase digital assets, the DAT model has been pitched as a new form of crypto-reserve asset holdings—often ...

In the summer of 2025, Digital Asset Treasury (DAT) companies became one of the most heated topics in capital markets. From continued crypto acquisitions by established players like Strategy to mid- and small-cap firms raising funds to directly purchase digital assets, the DAT model has been pitched as a new form of crypto-reserve asset holdings—often sending stock prices soaring upon announcement.

But as Bitcoin treasury growth noticeably slows and U.S. regulators step up scrutiny, the sustainability of this trend is being questioned. As regulatory cold water is poured on the frenzy, how long can the DAT market remain hot?

The “Wealth Flywheel” of the DAT Model

At the core of the DAT model lies a simple loop: public companies raise capital through equity, debt, or convertible bonds, then use the proceeds to purchase crypto assets like Bitcoin or Ethereum. As crypto prices rise, so do the companies’ balance sheets and stock prices—strengthening their ability to raise more capital, and perpetuating what some term a “wealth flywheel”:

- Capital Raising: Using a “digital asset strategy” as narrative to attract secondary market funding

Crypto Purchases: Deploying raised capital into BTC, ETH, and other major cryptocurrencies

Valuation Boost: Book value rises with crypto markets, lifting stock valuations—often at a premium

Refinancing: Higher market cap and visibility enable cheaper and larger future fundraising

MicroStrategy (now rebranded as Strategy) pioneered this model, raising $42 billion through stock and bond sales to accumulate Bitcoin. Its stock often traded at a 20%+ premium to its Bitcoin holdings. Other firms, like Japan’s Metaplanet, followed suit—using Bitcoin holdings to attract capital and fuel further purchases.

This trend helped drive both corporate valuations and Bitcoin’s price upward through early 2025. At its peak, the average corporate purchase of Bitcoin reached 1,200 BTC per transaction by Strategy and 343 BTC among other companies.

A Cooling Trend: Bitcoin Treasury Growth Slows

By August 2025, the expansion rate of corporate Bitcoin treasuries had slowed considerably. Per Bitbo reporting, corporate Bitcoin purchases fell 86% from their first-half highs, with the average transaction size dropping sharply. Monthly growth in BTC treasury holdings fell to around 16%, far below the >90% monthly growth rates seen earlier in the year.

While leading firms continued accumulating steadily, many smaller companies paused or scaled back crypto acquisition plans.

Data from CryptoQuant highlighted the slowdown: Strategy’s monthly purchases fell from 134,000 BTC in November 2024 to just 3,700 BTC by August 2025.

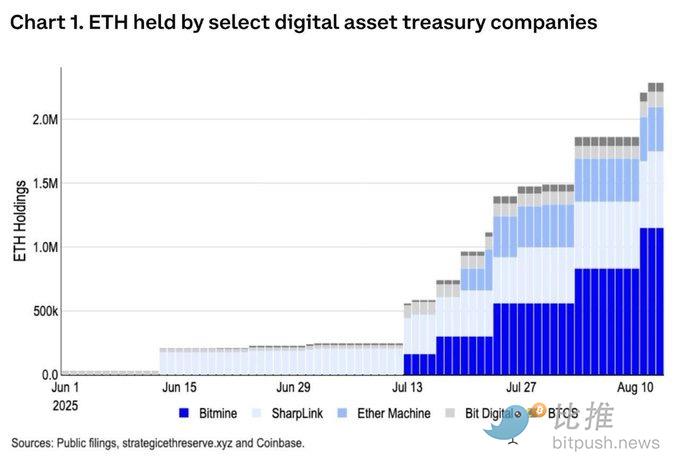

Meanwhile, Ethereum treasury activity accelerated markedly. Three leading companies purchased over 1.7 million ETH collectively in August—far exceeding Bitcoin treasury inflows that month. The shift appears driven by ETH’s staking yield potential, which offers a “capital efficiency” narrative absent from Bitcoin.

In short, while the DAT story continues, capital allocation is shifting from broad-based enthusiasm toward structural differentiation.

Several factors explain the cooling interest:

Reduced volatility: Bitcoin’s annualized volatility fell from nearly 200% in earlier years to around 50%, shifting its perception from speculative bet to mature allocation

Weakening flywheel: Companies can no longer rely on crypto holdings alone to turbocharge their stock prices

Slow macro liquidity recovery: Despite Fed rate cuts, institutional FOMO has been subdued

Rising regulatory scrutiny, particularly from Nasdaq

Regulatory Pushback: Nasdaq Raises the Bar

As reported by The Information, Nasdaq is increasing oversight of DAT-model companies—specifically those using fundraising primarily to buy crypto and boost share prices. Key measures include:

- Mandatory disclosure of fundraising use, especially whether capital is intended for crypto acquisitions

- Shareholder voting requirements for major crypto allocation decisions

- Enhanced risk disclosures regarding crypto volatility and financial exposure

- Tighter scrutiny of frequent capital raises followed by swift crypto conversions

These steps are designed to slow what regulators see as speculative excess. In the short term, DAT-related stocks have pulled back—particularly smaller names that previously rallied on buy announcements.

That said, extreme momentum plays remain. When Eightco announced plans to raise $270 million to purchase Worldcoin tokens in September, its stock surged nearly 5000% on volume tens of thousands of times its average. Such cases reveal that speculative interest in the “crypto + treasury” model remains potent.

Yet these very spikes invite further regulatory and short seller attention. The market is not uniformly cooling; rather, it is entering a phase where blue-chip DAT firms continue steadily, while tail-end names face pressure from both regulators and skeptics.

Is the DAT Market Overheated?

Three dimensions help evaluate the market’s temperature:

1. Valuation & Pricing

NAV premium: some companies trade at an 80%+ premium to their crypto holdings

Equity dilution cost: rising dilution per dollar of new crypto suggests an unsustainable model

2. Capital Flows & Momentum

Slowing BTC treasury growth vs. accelerating ETH accumulation

New institutional funding vehicles still emerging—e.g., a $500M DAT fund launched in Hong Kong

3. Regulation & Governance

Tighter listing and fundraising standards

Extreme volatility in names like Eightco serving as a magnifying glass on speculative excess

Overall, the DAT market isn’t uniformly declining—but it is transitioning from broad euphoria to selective stability.

Outlook: Three Potential Paths

Looking ahead, the DAT market may evolve in one of three ways:

1. Normalization: Leading companies continue growing within a compliance-first framework, eventually being valued as alternative asset managers

2. Shakeout: Smaller, hype-dependent firms struggle to raise funds under tighter rules and are gradually washed out

3. Capital Rotation: More funds flow from BTC treasuries into ETH—or into new vehicles offered by compliant funds

In summary, regulatory cooling doesn’t spell the end of the DAT trend. But its future will depend less on speculative storytelling and more on three factors: regulatory clarity, corporate governance, and capital allocation choices between BTC and ETH.

What comes after the cool-down may be a less frenzied, more steady market—and for discerning investors, that may be an opportunity in its own right.

Tags:

Link: The Crypto Treasury Boom Meets Regulatory Chill: Is the DAT Frenzy Fading? [Copy]