News

Gold’s $2.1 Trillion Plunge: Where Is The Smart Money Flowing Next?

Summary: Gold experienced a sudden and dramatic correction, plummeting over 6% within 24 hours after hitting a historical high above $4,300. This single-day drop, the largest since 2020, wiped out an estimated $2.1 trillion in market capitalization — a figure exceeding the entire crypto market’s valuation by half. The preceding rally in gold was fueled by ...

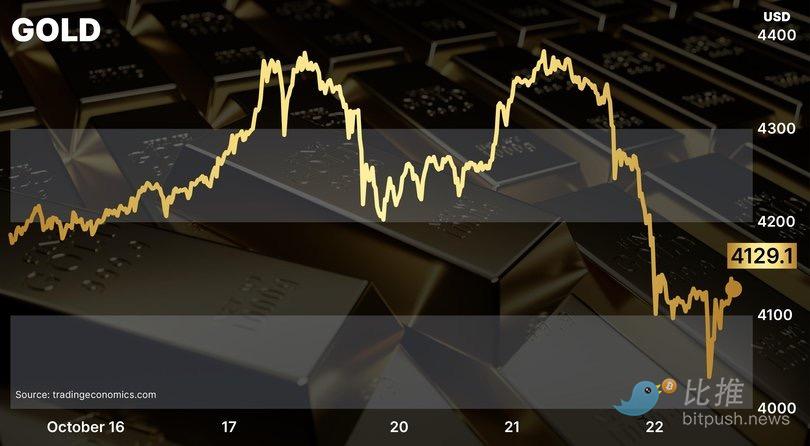

Gold experienced a sudden and dramatic correction, plummeting over 6% within 24 hours after hitting a historical high above $4,300. This single-day drop, the largest since 2020, wiped out an estimated $2.1 trillion in market capitalization — a figure exceeding the entire crypto market’s valuation by half.

The preceding rally in gold was fueled by three primary drivers: aggressive central bank buying (483 tonnes net purchased in H1 2025), escalating geopolitical risk, and the anticipation of a weaker dollar due to Fed rate cut expectations. The rapid, sharp correction suggests a classic “crowded trade” unwind, where mass profit-taking triggered a liquidity squeeze.

Crucially, this gold sell-off did not trigger systemic panic across all asset classes; COMEX open interest and ETF holdings remained relatively stable. Instead, speculative capital appears to be rotating into more agile and digitally scarce assets, with Bitcoin being the primary beneficiary.

Bitcoin Benefits from the Rotation

As gold retreated, Bitcoin (BTC) staged a robust recovery, rallying from a low of $108,200 to $113,800, posting a nearly 5% daily gain and pushing its market cap back above $2.1 trillion. This counter-movement, occurring alongside a mild recovery in the S&P 500, signals a notable shift in market risk appetite and potential capital rotation.

Key Data Points Confirming the Trend:

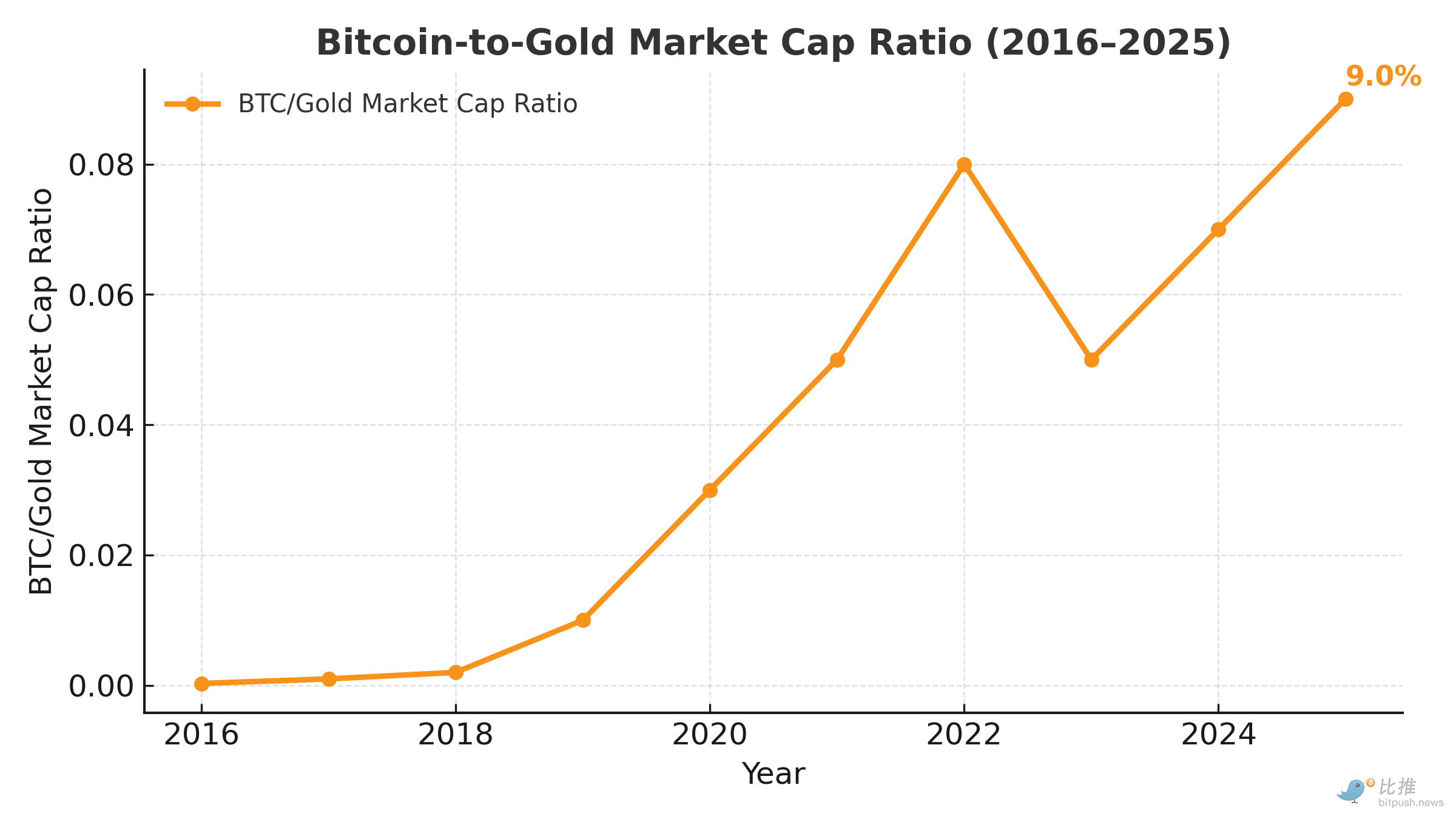

BTC/Gold Ratio Shift: The BTC/Gold ratio, which had fallen from 37 to 25 since mid-August, is now reversing. This suggests the market is re-evaluating the appeal of digital scarcity as gold shows signs of topping.

Institutional Footprint:

Institutional Footprint:

-

CME Holdings: Bitcoin futures open interest on CME increased by 22% since August, with institutional holders now accounting for 71% of the open positions.

-

ETF Inflows: BlackRock’s IBIT ETF saw $1.85 billion in net inflows this month, marking seven consecutive weeks of net subscriptions.

-

Future Growth Potential: With a market cap of approximately $2.1 trillion, Bitcoin is still a “lightweight player,” roughly 1/14th the size of the gold market ($30T). Institutions see this size discrepancy as immense future growth potential. Bitwise estimates that a 3–4% re-allocation from gold portfolios could drive BTC prices to the $160,000–$200,000 range.

Macro-Economic Logic of Capital Rotation

The rotation from gold to Bitcoin is underpinned by two major macro-economic themes: Scarcity in a High-Debt Environment and Generational Wealth Transfer.

1. Scarcity in a High-Debt Environment

With global total debt hitting a record $337 trillion in H1 2025, assets that cannot be printed are gaining attention. Both gold (historical trust) and Bitcoin (code-enforced scarcity) fulfill this role.

However, Bitcoin holds a critical advantage in liquidity and transportability. Gold’s physical limitations (storage, transportation, customs) contrast sharply with Bitcoin’s borderless, low-cost, minute-long cross-border transferability.

The two assets represent different phases of the monetary cycle:

The market appears to be transitioning into the second phase, with the CME FedWatch indicating a near-certainty of a 25 basis point rate cut in October, setting the stage for increased liquidity flow into high-beta assets.

2. Generational Wealth Shift

A predicted $84 trillion wealth transfer from Baby Boomers to Millennials and Gen Z by 2045 is structurally favorable to digital assets. Surveys show that approximately 54% of the younger generations hold crypto, compared to only 8% of the Boomer generation. This demographic shift ensures a long-term, systemic tilt toward digital asset preference.

Conclusion: A New Dual Anchor

The current market dynamic is not a zero-sum game but rather a re-allocation that highlights the complementary roles of the two assets.

Gold maintains its strength as a low-volatility reserve asset for central banks and large sovereign funds.

Bitcoin is evolving into a high-beta, non-correlated digital allocation for institutional and retail capital seeking high liquidity and long-term appreciation in a fiscally strained world.

The competition for the title of “ultimate store of value” has moved from visible metal to invisible code. Investors should monitor institutional ETF flows and major on-chain movements to gauge the pace of this accelerating capital rotation.

By: Bootly