News

Central Bank Digital Currencies Gaining Traction In 2020 Amid Growing Public Interest And COVID-19 Pandemic

Summary: Global central bank digital currency projects are becoming increasingly relevant in 2020 as COVID-19 riles the globe and public interest grows, a new report released on Monday, August 24 by the Bank for International Settlements showed. Central bank digital currencies (CBDCs) are digital forms of fiat money which can be built on distributed ledger technology like ...

Global central bank digital currency projects are becoming increasingly relevant in 2020 as COVID-19 riles the globe and public interest grows, a new report released on Monday, August 24 by the Bank for International Settlements showed.

Central bank digital currencies (CBDCs) are digital forms of fiat money which can be built on distributed ledger technology like blockchain. CBDC projects were directly inspired by the creation of Bitcoin, however most are not token-based and do not provide anonymous access. Countries around the world are beginning to launch research and development projects exploring what could be the next step in payment technology with 36 central banks having published CBDC research and six retail CBDC pilots ongoing by July of this year.

PC: Mailing money by Efile989 via www.efile.com

The report noted two metrics indicating CBDC projects are gaining traction both among government leaders and the general public: speeches and search engine inquiries. Since late 2018 speeches addressing CBDCs have taken on a more positive tone, whereas in prior years they were often either negative or dismissive towards the concept, speech analysis by report authors found. In the United States, CBDC research and development by the Federal Reserve has picked up during the COVID-19 pandemic as lawmakers encountered delays issuing stimulus relief money through checks or credit transfers. Many people did not receive their stimulus payments for weeks and were left without essential funds during the height of the pandemic.

PC: Rise of the central bank digital currencies: drivers, approaches and technologies via https://www.bis.org/publ/work880.pdf

Google search inquiries concerning CBDCs have also reached new heights, surpassing even Bitcoin. The increased public interest comes as central banks representing a fifth of the world's population have said that they would issue a CBDC very soon, the report states.

In advanced economies, the primary driver for developing a CBDC was to promote safety and robustness. In the United States one of the leading pushes for the creation of a CBDC to maintain the dollar's global dominance.

In emerging market economies domestic payment efficacy was the main motivation for developing a CBDC. The thinking is that a central bank digital currency could promote financial stability by creating a transaction trail which could curb illicit spending and allow for greater accountability in government spending. In the United States, this has been an argument against the development of a CBDC with lawmakers arguing that the technology may eclipse cash and that anonymous payments would no longer be possible. None of the CBDC projects currently in motion have the goal of ousting cash payments.

The researchers found that CBDC projects were most likely in countries with high mobile usage, a high innovation capacity and high search public search interest. China and Sweden were two countries with some of the most developed CBDC projects.

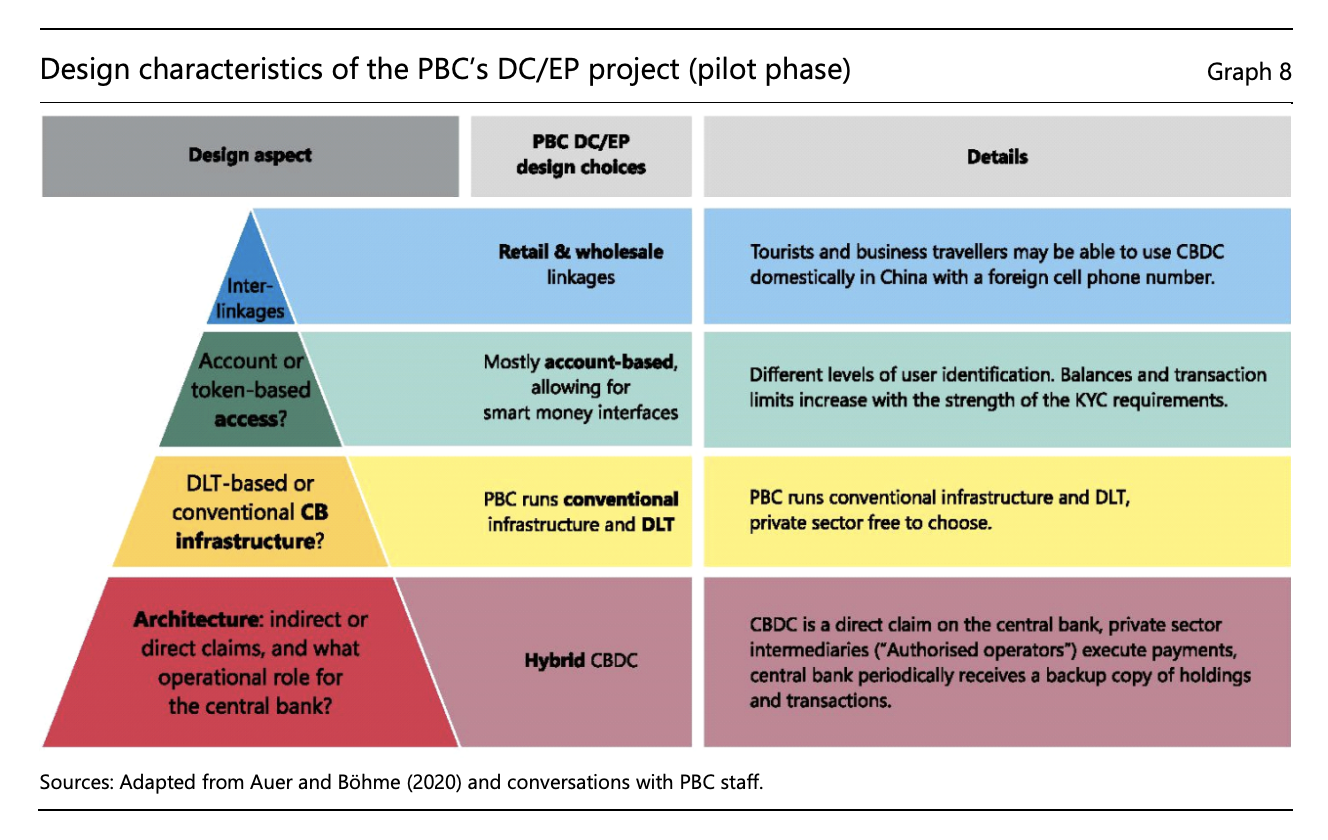

China's CBDC is currently being piloted in four Chinese cities. If widely implemented, both Chinese citizens and foreign visitors would be able to use the CDBC for retail purchases through a mostly accounts-based system. The Chinese model envisions a hybrid CBDC with the People's Bank of China providing the infrastructure while private sector intermediaries execute payments. The Central Bank would periodically receive a backup copy of holdings and transactions.

PC: Rise of the central bank digital currencies: drivers, approaches and technologies via https://www.bis.org/publ/work880.pdf

In Sweden, the use of cash is rapidly on the decline with many shops not even accepting cash. Given that the country is facing the most rapid decline of cash worldwide, Riksbank was one of the earliest to explore the use of a CBDC. The Swedish model focuses on wholesale payments, so it emphasizes utility when it comes to cross border payments. Larger purchases would have to run through an account, but smaller transactions could be carried out using anonymous tokens. Sweden's proof-of-concept also runs through the Riksbank with real-time payments occurring through intermediaries.

All CBDC projects are in early stages with lots of time for changes and structural overhauls to be carried out. However as the world economy grows increasingly digitized and the call for secure, fast payments intensifies, CBDC projects are becoming more and more relevant.

By Emily Mason

Tags: CBDC,CENTRAL BANK DIGITAL CURRENCIES

Link: Central Bank Digital Currencies Gaining Traction In 2020 Amid Growing Public Interest And COVID-19 Pandemic [Copy]