News

Could Decentralized Exchanges Replace Binance and Coinbase?

Summary: Centralized exchanges are in trouble. Not only are regulators like the SEC accusing top exchanges of violating numerous laws, but their decentralized competition is also improving. These competitors specialize in various tasks, from high-efficiency stablecoin swaps to perpetuals trading to general-purpose exchanging. In this article, we’ll compare these three categories of common centralized exchange features ...

Centralized exchanges are in trouble. Not only are regulators like the SEC accusing top exchanges of violating numerous laws, but their decentralized competition is also improving. These competitors specialize in various tasks, from high-efficiency stablecoin swaps to perpetuals trading to general-purpose exchanging. In this article, we’ll compare these three categories of common centralized exchange features to compare and contrast them to their decentralized counterparts.

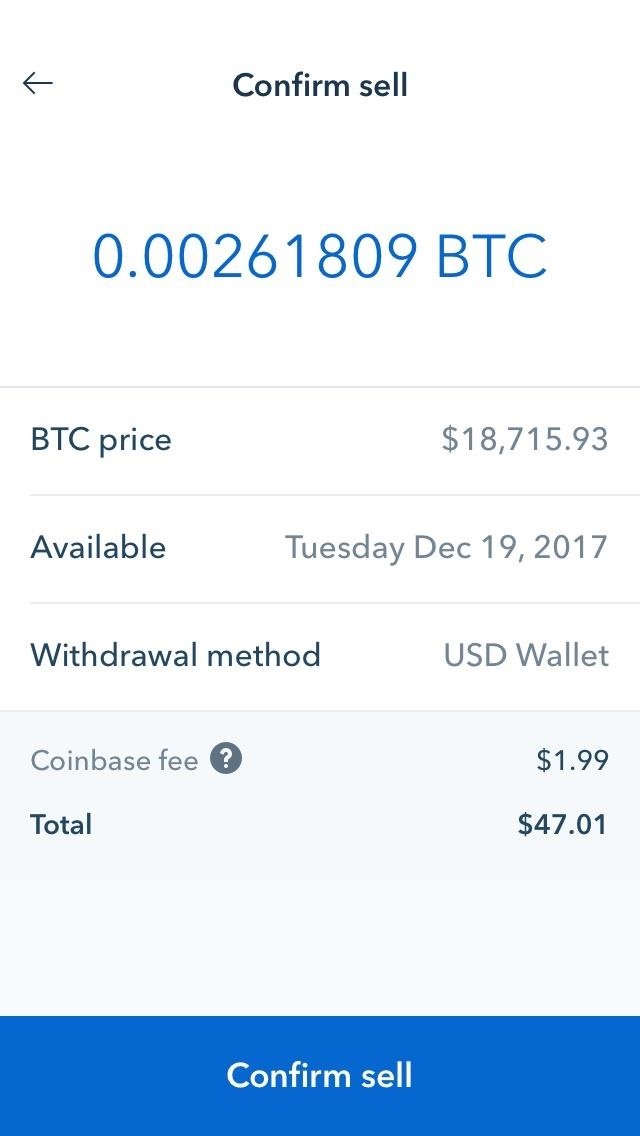

The most commonly used exchange feature is quite obvious: trading one cryptocurrency for another. Coinbase has notoriously high fees, ranging from 1.5% to 3%, depending on the order size. Binance is better, with a fee of around .4% on the US exchange and a fee of .1% on regular Binance. They used to allow users to pay the trading fee in BNB coin, Binance’s native token, for a 25% discount, but have retired this feature due to concerns about it making BNB more like a security. One of the biggest benefits of centralized exchanges is their high liquidity, and there is around a 1% spread on a Bitcoin purchase as high as $10,000.

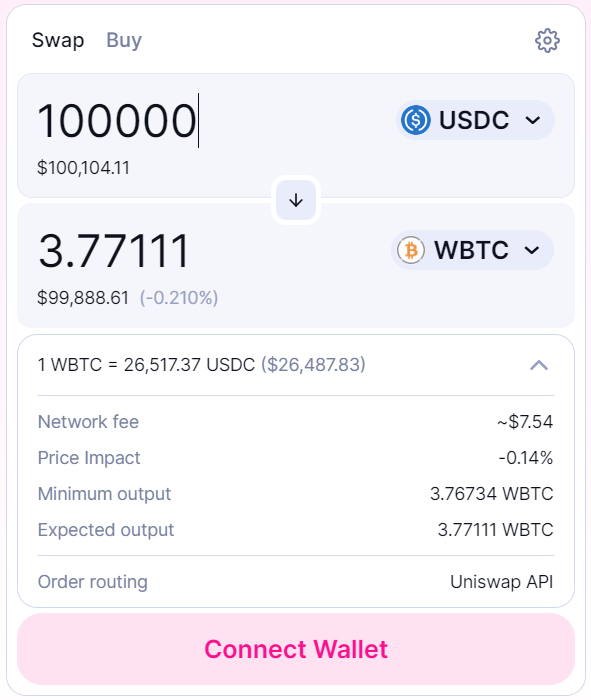

The biggest general-purpose DeFi exchange is Uniswap. Surprisingly enough, its decentralized automated market maker model provides very similar, if not better, rates compared to its centralized competitors. It has three trading fees, 0.05%, 0.30%, and 1%, based on the type of asset being traded and its volatility. The liquidity for top assets is incredibly high, and a $100,000 USDC to BTC exchange, ten times more than the Coinbase trade, only has 0.14% in slippage. Additionally, Uniswap offers users the option to be on the other side of these trades and provide liquidity to earn the trading fee from every transaction. Curve Finance, the largest exchange by total value locked, is specialized in exchanging stablecoins and other like assets and can do so with 0.04% fees. Some DeFi platforms, like 1Inch and Matcha, exist solely to aggregate the best prices from the top DeFi exchanges to give users the best rate. Together, these options provide the same experience at similar or lower fees for the average user while having a much greater selection of assets and the option to provide liquidity.

Perpetuals, or perpetual contracts, are a type of futures contract, which is an agreement to buy or sell an asset at a specific price in the future. Unlike regular futures contracts with a set expiration date, perpetual contracts do not have an expiration date and can be held indefinitely. Traders often use margin and leverage to achieve riskier positions with a high potential for both gains and losses, as well as bet on the price of an asset going down. As a US-based exchange wary of violating regulations, Coinbase does not offer futures trading, but Binance’s worldwide platform does with a 0.015% fee and up to a whopping 125x leverage.

There are two main DeFi perpetuals exchanges: dYdX and GMX. dYdX is the older of the two and was originally built on Starkware, but it is now migrating to its own Cosmos-based chain to achieve greater customizability, decentralization, and scalability. GMX is a newer, Arbitrum-based DEX that became known for popularizing the idea of “real yield,” paying token holders from the fees on the platform instead of unsustainable emissions. dYdX allows for up to 20x leverage and charges no fee on the first $100,000 of trading volume per month then a fee that decreases from 0.02% back to 0 as trading volume goes from $100,000 to $50 million. GMX charges a flat 0.1% fee, significantly higher than the other options, but offers up to 50x leverage.

Overall, it appears that decentralized exchanges are the same or better than their centralized counterparts for spot trading, whereas centralized exchanges succeed or are equal to DeFi for perpetuals trading. Another aspect that was not considered is the benefits of decentralization and trustless platforms. On a centralized platform, you must trust that the company will honor its agreement to safely custody your funds and allow withdrawals. As we have seen in numerous cases, like FTX, Mt. Gox, and BlockFi, this is far from guaranteed, and the only way to truly own your cryptocurrency is by storing it in a wallet. Decentralized exchanges never custody funds, and crypto never leaves your wallet unless the trade is successfully executed.

Centralized exchanges do have their benefits, though. One critical service they provide is on-ramping fiat money to crypto, which is required before any DeFi exchange can be used. Additionally, they are simpler than setting up a wallet and may be the better option for non-technically savvy individuals.

With Coinbase and Binance’s futures uncertain, decentralized exchanges have an inflection point at which they could take a large portion of the exchange market share. Though they will never own the crucial on-ramp portion of the exchange business, they have the innovation and competitive edge to take the rest.

By Lincoln Murr

Tags: Binance,Coinbase,Curve,DeFi,dYdX,GMX,Uniswap

Link: Could Decentralized Exchanges Replace Binance and Coinbase? [Copy]