News

Real-World Assets: The Next Big Thing for Blockchain?

Summary: Decentralized finance, or DeFi, is one of the most innovative industries brought about by blockchain technology. The ability to permissionlessly make transactions with anyone, anywhere in the world, is revolutionary for the financial sector and has spawned the creation of protocols like Uniswap, Aave, and others. Yet, the introduction of real-world assets on the blockchain ...

Decentralized finance, or DeFi, is one of the most innovative industries brought about by blockchain technology. The ability to permissionlessly make transactions with anyone, anywhere in the world, is revolutionary for the financial sector and has spawned the creation of protocols like Uniswap, Aave, and others. Yet, the introduction of real-world assets on the blockchain could be an even bigger market opportunity than anything we’ve seen thus far. Let’s look at the real-world assets movement, its potential, and what projects will most likely dominate the space.

Up until now, DeFi has been mostly restricted to blockchain-native assets like tokens or cryptocurrencies. While this has ballooned into a $100 billion industry, there is much more potential in the pre-existing world to tap into. All sorts of assets, like metals, stocks, bonds, debt, properties, and so much more, could be tokenized.

The tokenization of assets can provide several advantages over the current model. First, it offers increased liquidity by enabling fractional ownership. For instance, an investor can buy a small percentage of a tokenized property rather than purchasing an entire property. Additionally, integrating RWAs with DeFi makes it possible to provide liquidity, loan, and borrow real-world assets, greatly increasing their earning potential and capital efficiency. Tokenization also provides transparent and immutable record-keeping, ensuring all transactions are traceable and tamper-proof, keeping large financial entities in check with greater accountability.

Tens of trillions of dollars in assets could be brought to the blockchain. Some protocols are already beginning to create an on-chain RWA market. For example, DeFi protocol Goldfinch allows users to loan stablecoins to businesses around the globe in several different sectors, including Emerging Southeast Asia, African Innovation, and Carbon Reduction Fintech, all of which are paying an APY of over 12%. Their Senior Pool also automates and diversifies investing across all pools and pays 7.78% APY. Another protocol, Ondo Finance, has tokenized US Treasury bills and other assets to provide the lowest-risk yield on-chain. These bills are paying a decent 4.85% APY given current economic conditions. Their sister protocol, Flux Finance, allows lending and borrowing these tokens, unlocking the world of DeFi on T-Bills.

Chainlink, though not directly creating RWAs, is a critical piece of infrastructure in the creation process. Thanks to their decentralized Proof of Reserve verification mechanism, they can verify the collateral’s existence and ownership and bridge the trust gap between the real world and blockchain data.

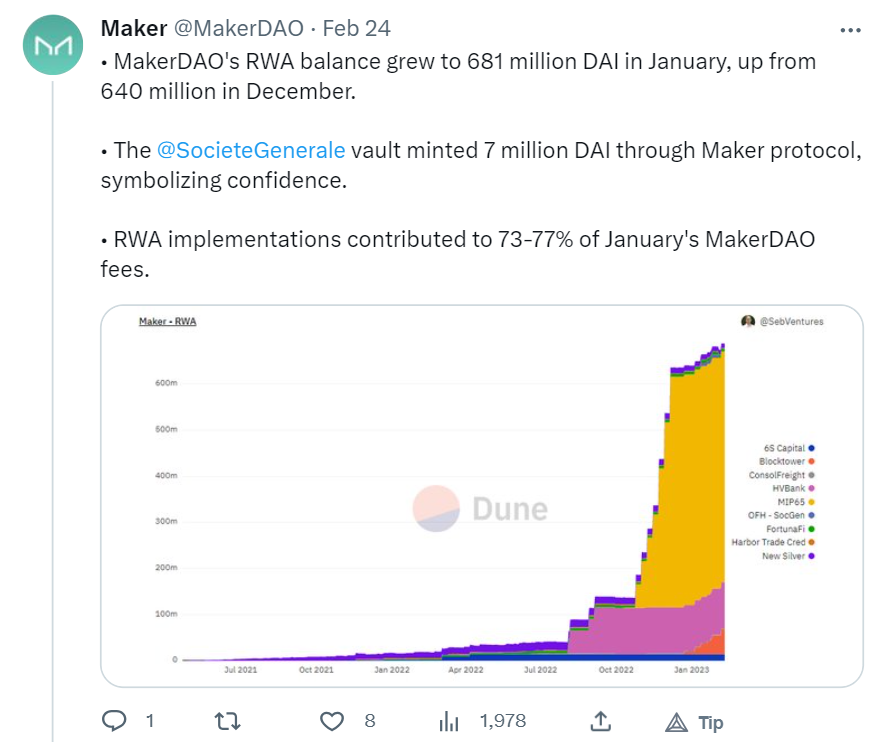

MakerDAO, the protocol behind the DAI stablecoin, has been adopting RWAs into its basket of collateral supporting DAI, including short-term bonds, bank and real estate loans, and credit assets. Not only have these forms of collateral proven to be stable, but they've also provided a significant boost to the DAO's revenue.

The idea of tokenizing securities has existed since around 2017 but has not seen any serious adoption. This is due to a few reasons, but namely because of regulatory concerns surrounding securities being transacted on-chain. At any point, the government could freeze the collateral behind tokenized assets or sanction the trading protocols. Goldfinch and others attempt to be compliant by requiring users to be accredited investors in some cases and requiring KYC verification through a third party, but this may not be enough to satisfy the SEC. Hopefully, greater clarity will be provided due to the ongoing cases involving the SEC, Binance, and Coinbase. Another reason RWAs have yet to explode is that the past few years have seen mediocre returns on assets like bonds and treasury bills. Now that they are paying significantly higher and the cryptocurrency market seems to be amid a bear, it could be time for these assets to rise to prominence.

Real-world assets seem primed to dominate the blockchain industry over the next several years, but the question of regulation is holding them back from reaching their full potential. Trillions of dollars in assets are sidelined and will likely not be tokenized until there is clarity from governments. Until then, the best way to bet on the adoption of RWAs is to find protocols that have a clear market advantage, understand the risks involved with the space, and work to bring about the changes needed to make RWAs happen.

By Lincoln Murr

Tags: Chainlink,DeFi,Goldfinch,MakerDAO,Real world asset,RWA

Link: Real-World Assets: The Next Big Thing for Blockchain? [Copy]