News

Can a $300M RWA Fund Save Avalanche's TVL?

Summary: In one of the crypto industry's most compelling narratives—the tokenization of Real-World Assets (RWA)—Anthony Scaramucci is once again at the forefront. The Wall Street veteran, a former Goldman Sachs vice president and well-known for his brief stint as White House Communications Director in the Trump administration, is now the head of SkyBridge Capital. He is ...

In one of the crypto industry's most compelling narratives—the tokenization of Real-World Assets (RWA)—Anthony Scaramucci is once again at the forefront.

The Wall Street veteran, a former Goldman Sachs vice president and well-known for his brief stint as White House Communications Director in the Trump administration, is now the head of SkyBridge Capital. He is betting on "fund tokenization," announcing that SkyBridge will tokenize approximately $300 million of its assets, representing about 10% of its total assets under management (AUM), on the Avalanche blockchain.

For Scaramucci, this is more than just a technical experiment; it's a bet on the future of finance. In an interview with Fortune magazine, he stated that the period from 2026 to 2027 will be the "era of Real-World Asset tokenization." He believes tokenization's value lies not only in improved efficiency but also in redefining the way traditional financial products are traded and circulated.

Scaramucci's Journey from Wall Street to Crypto

Before entering the crypto world, Scaramucci's career was already legendary. After graduating from Harvard Law School, he joined Goldman Sachs as a vice president in the investment banking division. In 1996, he founded Oscar Capital, which was later sold to Neuberger Berman. In 2005, he launched SkyBridge Capital, growing it into an influential asset management firm in the alternative investments space.

In 2017, he became a media focus as the White House Communications Director for a mere 11 days, an event that cemented his dual identity as a "Wall Street veteran" and a figure from a "White House storm." After leaving politics, Scaramucci remained active in investing and quickly embraced cryptocurrency after 2020. SkyBridge launched Bitcoin and Ethereum funds, and Scaramucci became a vocal advocate for the crypto industry.

Despite a stumble with his FTX investment, his long-term conviction remains unshaken: the convergence of crypto and traditional finance is an irreversible trend, and tokenization is the most promising bridge.

The RWA Craze: US Treasury Bills vs. Fund Tokenization

The RWA trend began with "on-chain US Treasury bills." With the Fed's rate hikes, US Treasury bonds and money market funds became the most sought-after on-chain assets due to their low risk and stable yield, making them ideal for DAOs, stablecoin issuers, and exchanges.

SkyBridge's approach differs from the mainstream RWA path. It's not choosing low-risk Treasury bills but rather two hedge funds: one for crypto assets not classified as securities by the SEC, and a "fund of funds" that includes SkyBridge's venture and crypto products. These assets target a higher-net-worth clientele and have limited liquidity but offer higher returns and a differentiated market position.

Avalanche’s Position: Can RWA Reverse Its TVL Decline?

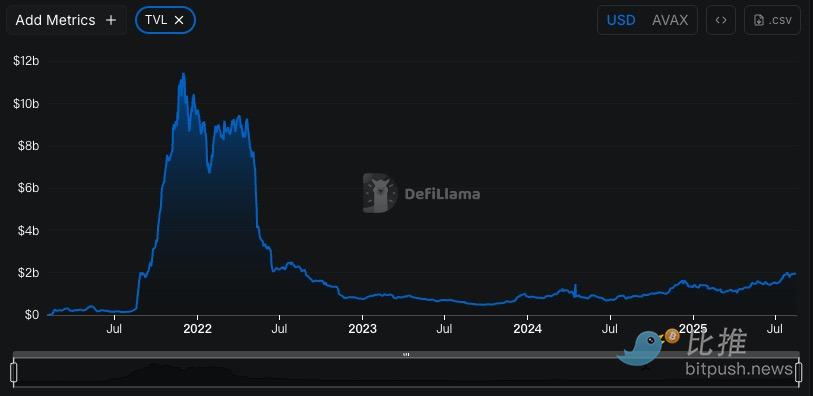

Avalanche once rivaled "Ethereum killers" during the 2021-2022 DeFi boom, with its Total Value Locked (TVL) peaking at over $11 billion. However, as the market cooled and with Solana's strong rebound and the explosion of Ethereum L2s, Avalanche's momentum has noticeably slowed.

Shrinking TVL: According to DefiLlama, Avalanche's current DeFi TVL is less than $2 billion, a significant drop from its peak.

Declining Ecosystem Activity: Compared to Solana's full-scale recovery in meme coins, NFTs, and DeFi, Avalanche's user growth and application activity have been lackluster.

Lack of New Narrative: Amid the proliferation of Layer 2, Solana, and Bitcoin L2 narratives, Avalanche has lacked a viral, breakout story.

Most RWA projects favor Ethereum due to its mature compliance infrastructure and institutional recognition. Solana is gaining traction with its high performance and low costs, while Aptos is positioning itself as a "new compliant public chain" for experimentation.

Avalanche was not the top choice for RWA projects, but its Subnet architecture is custom-built for institutions, allowing them to create dedicated, private blockchain environments for compliance, custody, and auditing. This is precisely what SkyBridge values.

With SkyBridge's "endorsement," Avalanche is attempting a breakthrough in the crowded RWA space. However, this isn't its only move. This year, Bergen County, one of the wealthiest suburbs of New York, announced it would migrate 370,000 property deeds—totaling $240 billion in value—onto the Avalanche chain. These deeds will be stored in an immutable, searchable on-chain ledger, representing the world's first large-scale digitization and on-chain migration of real estate deeds.

This means Avalanche is not just betting on financial products but is also trying to build an on-chain ecosystem around two major traditional asset classes: funds and real estate.

So, can RWA bring liquidity to Avalanche?

The problem is that the RWA market is not an overnight success story. While the SkyBridge and Bergen County cases are symbolic, they may not immediately translate into on-chain trading activity:

Tokenization of hedge fund shares targets high-net-worth individuals, so liquidity is inherently limited.

Placing property deeds on-chain is closer to creating a "digital archive." It is still far from true financialization, such as mortgages or secondary trading, due to institutional and market hurdles.

Avalanche needs more than just "headlines." It needs to build a complete ecosystem of applications and financial products around these assets to genuinely attract funds and get capital flowing into its on-chain economy.

In other words, RWA provides a new narrative for Avalanche, but whether it can turn into new liquidity depends on the ecosystem's ability to build trading, lending, and other on-chain markets around these assets.

Outlook: Three Possible Scenarios for Avalanche

RWA offers a fresh story for Avalanche, but the outcome could be varied:

Successful Transformation into an Institutional Chain: If the SkyBridge and Bergen County cases attract more funds, banks, and local governments, Avalanche has a chance to build a moat in the "on-chain institutional a

nd public assets" sector. It may not become the main battlefield for DeFi but could become the core infrastructure for tokenizing real-world assets.

Continued Marginalization: If RWA remains a "news effect" without bringing real trading and liquidity, Avalanche's position will not fundamentally improve. The RWA halo could eventually be absorbed by Ethereum, Solana, or even new compliant chains.

Waiting for the Next Narrative: Avalanche might gain some attention through RWA, accumulating resources for the next industry narrative (e.g., AI + blockchain, national digital currencies, cross-border settlement). RWA may not directly bring liquidity, but it could preserve its chance for a future comeback.

Conclusion

RWA is moving from a concept to reality. Data from RWA.xyz shows the tokenization market has doubled to $26 billion in the past year, with institutions like McKinsey and Ripple predicting it could grow into a trillion-dollar industry by 2030. Within this context, Avalanche is not betting on the popular US Treasury bill space but on high-net-worth funds and real estate deeds.

This path is riskier, but if it succeeds, Avalanche might genuinely find a path to survive that is different from Ethereum and Solana.