News

U.S. SEC Clears Path for Institutional Crypto Custody, Recognizing State Trust Companies as Qualified Custodians

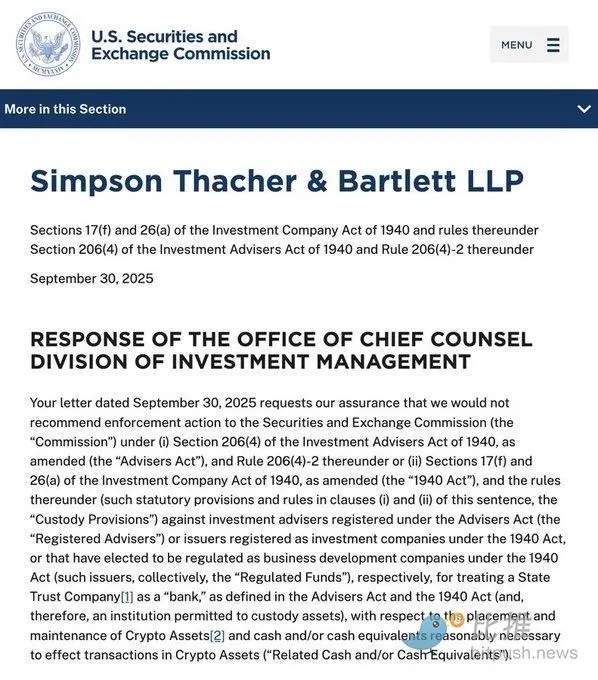

Summary: In a significant policy shift, the U.S. Securities and Exchange Commission (SEC) has issued a no-action letter confirming that registered investment advisers and regulated funds may custody crypto assets with state-chartered trust companies without facing enforcement action. The move, announced today, resolves years of regulatory uncertainty around whether state trust companies can serve as qualified ...

In a significant policy shift, the U.S. Securities and Exchange Commission (SEC) has issued a no-action letter confirming that registered investment advisers and regulated funds may custody crypto assets with state-chartered trust companies without facing enforcement action.

The move, announced today, resolves years of regulatory uncertainty around whether state trust companies can serve as qualified custodians for digital assets like Bitcoin and Ethereum. The SEC’s Division of Investment Management stated that such companies would be treated as “banks” for crypto custody purposes under specific conditions.

This decision marks a notable reversal from the SEC’s previous stance under former Chair Gary Gensler, who had advocated for stricter custody requirements that would have limited crypto custody to traditional banking institutions.

Background: From Resistance to Acceptance

The SEC’s move represents the latest development in a five-year regulatory evolution. Federal agencies, including the Federal Reserve, Office of the Comptroller of the Currency, and Treasury Department, had previously restricted regulated financial institutions from serving crypto companies through what became known as “Operation Choke Point 2.0.”

The current SEC leadership under Chair Paul Atkins has pursued a different approach through its “Project Crypto” initiative, shifting from resistance to structured acceptance of digital assets.

Key Requirements for Compliance

According to the SEC’s guidance, investment advisers and funds must meet four key conditions when using state trust companies for crypto custody:

1. Annual Due Diligence: Advisers must verify that trust companies maintain proper state banking authorization, robust internal controls against theft and key mismanagement, and independently audited financial statements with SOC-1/SOC-2 reports.

2. Written Custodial Agreements: Trust companies cannot lend, stake, or re-hypothecate crypto assets without client consent and must maintain asset segregation.

3. Risk Disclosure: Advisers must fully disclose potential risks of using state trust companies for crypto custody to clients or fund boards.

4. Best Interest Assessment: Advisers or fund boards must reasonably determine that the custody arrangement serves clients’ or shareholders’ best interests.

Industry Applauds Regulatory Clarity

Market participants welcomed the move as a milestone for digital asset regulation.

“This is a textbook example of more clarity for the digital asset space — exactly the sort of thing the industry was asking for over the last few years,” said James Seyffart, Bloomberg Intelligence analyst.

Senator Cynthia Lummis (R-WY) commented on X: “Encouraged to see @SECGov recognizing state-chartered trust companies as qualified digital asset custodians. Wyoming paved the way in 2020 by issuing landmark no-action relief, & was criticized by SEC staff. They finally recognized the rigor & value of WY’s digital asset supervision.”

Major crypto firms operating under state trust charters, including Coinbase Trust, Kraken Trust, and Anchorage Digital Bank, stand to benefit from the clarified regulatory framework.

Market Implications and Future Outlook

The no-action letter carries implications beyond immediate compliance relief:

• Accelerated institutional adoption: Investment advisers and funds now have a clear path to legally custody Bitcoin and Ethereum.

• Enhanced role for state trust systems: State-level regulators in Wyoming, New York, and Texas will play increasingly important roles in crypto financial infrastructure.

• Continued institutionalization: Following ETF approvals, legitimate custody solutions represent another critical piece for institutional crypto participation.

• Legislative momentum: While not formal law, the guidance provides practical foundation for potential digital asset market structure legislation.

The SEC’s action removes a fundamental barrier to traditional financial participation in digital assets, potentially paving the way for increased institutional allocation to cryptocurrencies as the regulatory landscape continues to mature.

Tags:

Link: U.S. SEC Clears Path for Institutional Crypto Custody, Recognizing State Trust Companies as Qualified Custodians [Copy]