News

Trader Joe: The Most Innovative Decentralized Exchange?

Summary: Decentralized exchanges (DEXs) are at the forefront of the DeFi revolution, fostering a new era of financial innovation and accessibility. Uniswap, the pioneer, set a strong foundation, but the landscape is far from stagnant. Emerging from its humble beginnings as a Uniswap clone, Trader Joe has taken the DeFi world by storm. With numerous novel ...

Decentralized exchanges (DEXs) are at the forefront of the DeFi revolution, fostering a new era of financial innovation and accessibility. Uniswap, the pioneer, set a strong foundation, but the landscape is far from stagnant. Emerging from its humble beginnings as a Uniswap clone, Trader Joe has taken the DeFi world by storm. With numerous novel features and an innovative Order Book model, Trader Joe is becoming an increasingly attractive choice for liquidity providers. This article delves into the evolution of Trader Joe, its cutting-edge additions, and the potential of JOE as a robust investment opportunity.

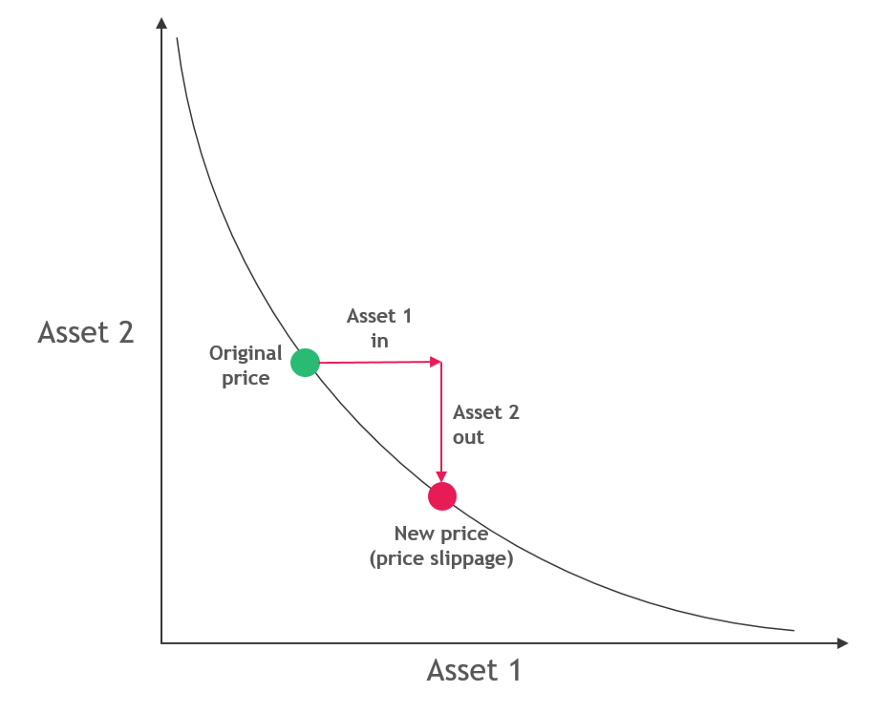

Trader Joe was released in September 2021 and was one of the first decentralized exchanges on the Avalanche blockchain. Initially, it was no different than the numerous other Uniswap clones that appeared on new blockchains. These DEX clones follow a simple math formula to determine the price of an asset at any given time: x*y=k, where x and y are the supplies of the two tokens being traded, and k is a constant value. Whenever someone wants to buy x, it imbalances the formula, causing the price of y to increase consequently. This mechanism, while novel, leads to issues related to capital inefficiency. It also causes impermanent loss when liquidity providers, those who provide the assets for users to trade in exchange for a fee, do not make as much as they would by simply holding the two assets due to price fluctuations.

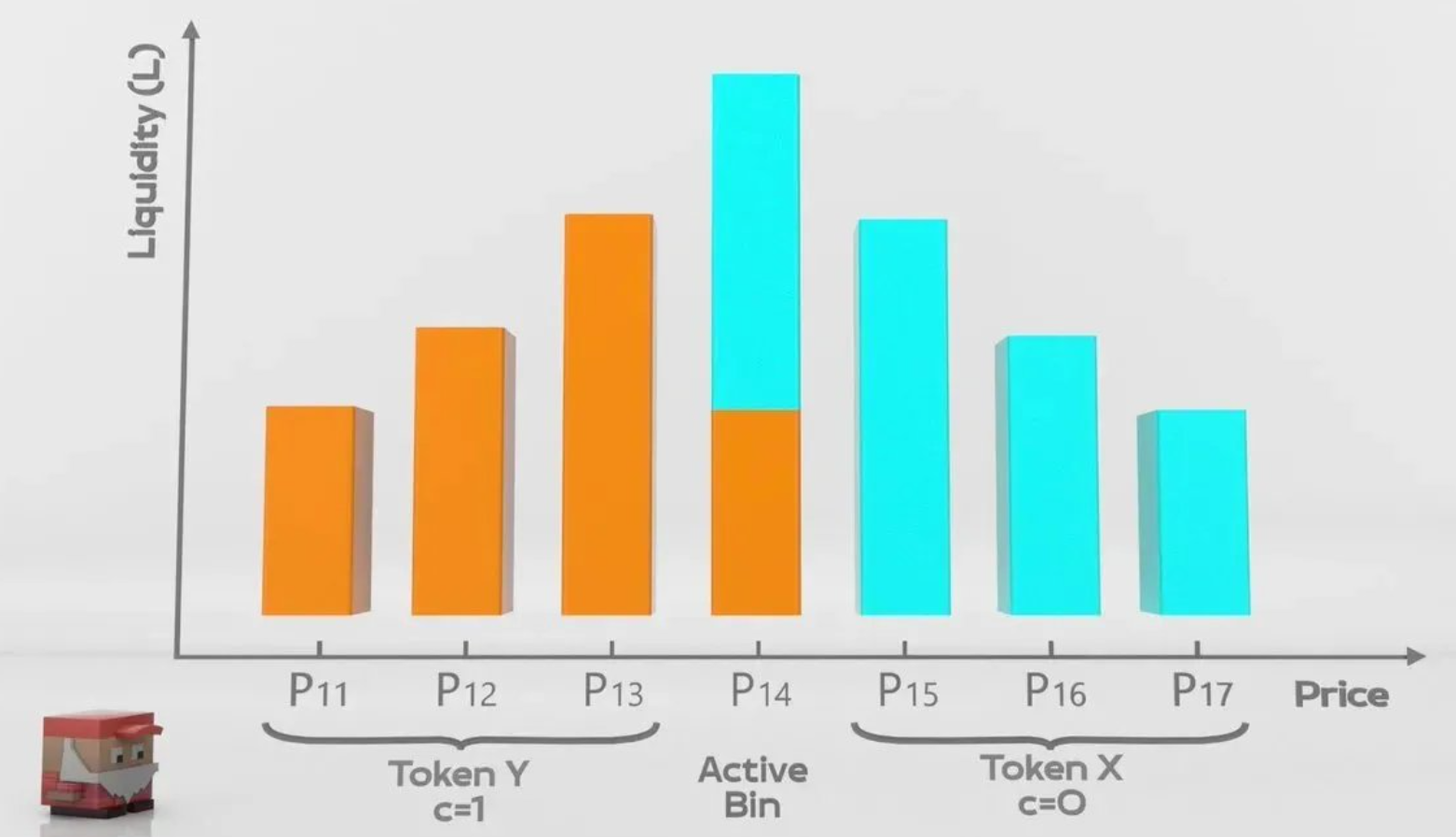

In August 2022, Trader Joe released its V2 update, introducing a new liquidity book (LB) design. It combines elements of a traditional order book, like those seen in stock markets where users place buy and sell orders at certain prices, with DEX models. In it, liquidity providers deposit their assets into a specific price “bin” and only get fees paid to them if their bin is active. This provides much greater flexibility, as users can pick from pre-set strategies to fine-tune their level of risk and efficiency for several different situations.

V2 also introduced a two-tiered fee structure for trades. Instead of having one flat fee, Trader Joe has a base fee and a variable fee for surge pricing, which increases the fee based on an individual trading pair’s volatility. This reduces impermanent loss further by compensating liquidity providers during periods of rapid price movement.

On June 1st, the protocol released its long-awaited Auto-Pool feature, which automatically rebalances liquidity, removing the need for users to be active in choosing which price bin to use. This feature gives Joe the simplicity of any other DEX with the efficiency and volatility resistance enabled by the liquidity book model.

JOE, the protocol token, can be staked on the platform for a share of protocol fees, paid out in USDC. According to their website, staking JOE pays a 26.49% APR, though this is subject to the exchange’s volume. It can also be used to boost earnings in liquidity farms and vote on changes to the protocol, like most DEXes, but this feature is being phased out to focus on real yield. Joe has also partnered with interoperability protocol LayerZero to make JOE an omnichain token, making it possible to send it across several blockchains seamlessly. The token’s market capitalization is currently $116 million, down from $550 million in 2021. While its use as a passive income tool is promising and could provide stable income, there is a risk that the SEC or some other government regulatory agency sees this as reason enough to label JOE a security, which would cause numerous issues and potentially devastate the protocol. There is a reason that Uniswap has yet to provide fees to their token holders, and any protocol that does is running the risk of regulatory woes.

Trader Joe represents a significant leap forward for decentralized exchanges, carving out its niche with a unique Liquidity Book model and other innovative features designed to simplify liquidity provision. Whether or not it will succeed in the long term remains to be seen, but its commitment to continued development will certainly ensure it stays relevant for the near future.

By Lincoln Murr

Tags: Avalanche,Decentralized Exchange,DeFi,JOE,Trader Joe,Uniswap

Link: Trader Joe: The Most Innovative Decentralized Exchange? [Copy]